The unbundling of banks

By 2030 we won’t ask why traditional banks are gone, we will wonder why they hadn’t disappeared years ago.

Banks are truly awful. Ignored or forgotten most of the mega banks of 2021 only exist due to the socialization of their losses in 2008, and being propped up by preferential lending from our central bank today. Despite or more likely because of this preferential treatment by the government, banks have largely failed to innovate while abusing their customers with high unnecessary fees for increasingly commoditized services. Interacting with the mega banks summons a feeling of nostalgia as you’re plunged into an antiquated era where it is still acceptable to do commerce via dead trees and fax machines while other companies are regularly launching self landing rockets into space. Many interactions with these dinosaurs will require you to enter one of their many no doubt expensive locations where despite being near empty will provide you a level of customer service that would make a DMV employee blush.

By 2030 we won’t ask why traditional banks are gone, we will wonder how they lasted so long.

If banks are the dinosaurs then fintechs are the mammals. Fintechs are usually small and specialized businesses undergoing adaptive radiation while the current dominant lifeforms fail to adapt to a changing world. Welcome to the Eocene Epoch.

After reading the above it should surprise you that banks do still exist and provide a variety of services people voluntarily consume. Today banks are essentially a bundle, a bundle being a convenient form of distribution for goods and services. It made sense prior to the microprocessor and internet that you’d have a relationship with your local bank where they would know both your character and finances. This bank would provide a one stop shop for earning money on your savings, investing for retirement, and financing your home or car.

Bundling and unbundling

“I said, really just to end the conversation, Gentlemen, there’s only two ways I know of to make money: bundling and unbundling.” - Jim Barksdale

As mentioned above bundles are just a convenient form of distribution for goods and services. My hypothesis is that bundles largely arose out of distribution restraints not out of customer preference. Media bundles such as broadcast and cable television, newspapers, or music are all classic examples of bundles that have been unbundled, unlocking massive value to both producers and consumers. In a world of the microprocessor and internet you can slice and dice the media you want to consume. We are no longer subject to a newspaper editorial, now we can consume the news in a curated feed of niche interests. The same holds true for music via iTunes or Spotify, niche education and entertainment via Audible and Podcasts, and specific shows that interest you via streaming services and YouTube.

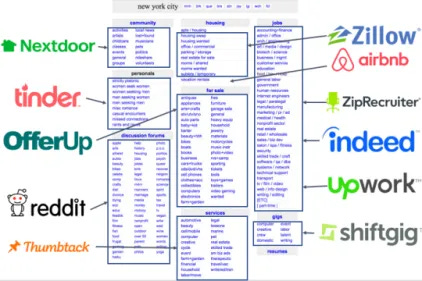

Even internet companies get unbundled by new internet companies with laser-like focus on a single vertical, the classical example being Craigslist below. Capitalism’s creative destruction hates stagnation and encourages ever better user experiences.

Craigslist Unbundled

Banks Unbundled

This brings us back to banks, banks have historically been less subject to the above due to a protective regulatory environment and the structural advantages that provided. Despite that there has been an explosion of new highly focused companies attacking every vertical that banks profit from.

Banks and Brokerage services have begun to unbundle in ways that seemed impossible just a couple years ago as shown by this fantastic graphic above.

What is currently bundled into banks?

From Chase’s Website:

Credit Cards

Checking and Savings accounts

Home Loans

Auto Loans

Commercial Loans

Credit Scores

Merchant Services (Point of Sale, Payments)

Business Lending

Investing Services

Retirement Plans

What does this look unbundled? It looks like a series of hyper focused companies going after each vertical above.

If you are interested in the specific players disrupting banking incumbents you can dig into the list below, otherwise I will leave you with these parting thoughts:

The time is now to disrupt these institutions, low rates and a lack of technological innovation actually tilt the advantage to new entrants. If you are starting a company in this space you should aim to provide excellent UX and customer service with a focus on a single vertical at least at first. You should also reach out to me, a former fintech founder passionate about the space. Likewise if you are a VC or investor interested in fintech you should also reach out to me. I would love to help both parties above remove the frictions and end the dark patterns banks monetize today via competition.

The fintech list

Debit / Credit Card Issuance

Non-bank players: VISA and MasterCard are non-banks themselves and manage the infrastructure around payments. These cards were historically issued by banks which actually charge the interest and take the lending risk.

Startups doing card issuance include:

Stripe

Payments infrastructure for the internet

Galileo

The API Standard for Card Issuing and Digital Banking

ModernBanc

Launch banking products fast. (accounts, cards, and loan products)

Synapse

The Launchpad for Financial Innovation

Lastbit

Pay or Get Paid in Bitcoin or Euros

Letter

Beautifully designed banking made for high net-worth individuals.

Starship HSA

MONEY FOR HEALTH.

Checking and Savings accounts (Personal)

Synapse

The Launchpad for Financial Innovation

Galileo

The API Standard for Card Issuing and Digital Banking

ModernBanc

Launch banking products fast. (accounts, cards, and loan products)

LVL

Bitcoin custodian and FDIC insured checking

Checking and Savings accounts (Business)

Mercury

Banking built for startups

Bank Novo

Powerfully simple business banking

Arival

The first fintech bank

Synapse

The Launchpad for Financial Innovation

Modern Banc

Launch banking products fast. (accounts, cards, and loan products)

Home Loans

Better

Blend

Point

Salt Lending

Auto Loans

Carvana

Upstart

Upgrade

Commercial Loans

nCino

The Worldwide Leader in Cloud Banking

Credit Scores

Credit Karma

Intuit

https://turbo.intuit.com/free-credit-score-report/

Merchant Services (Point of Sale, Payments)

Square

PayPal

https://www.paypal.com/us/home

Stripe

Adyen

Clover (Fiserv)

Business Lending

Kabbage

Crowdz

Investing Services

Consumer Facing

Robinhood

Public

Trade Republic

Equilibrium Ventures

https://www.equilibriumventures.com/

Vinovest

Otis

Starship HSA

Farm Together

Tuned

Tribevest

Retirement Plans

Wealthfront

Betterment

Sofi

Acorns

API Driven Banking

Modern Banc

Launch banking products fast. (accounts, cards, and loan products)

API Driven Investing

DriveWealth

Alpaca

Gallileo

*I have invested in one or more of these companies.

Disclaimer

In no event will Prdctnomics or any of the Prdctnomics parties be liable to you, whether in contract or tort, for any direct, special, indirect, consequential, or incidental damages or any other damages of any kind even if Prdctnomics or any other such party has been advised of the possibility thereof.

The writer’s opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by Prdctnomics constitutes an investment recommendation, nor should any data or Content published by Prdctnomics be relied upon for any investment activities.

Prdctnomics strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.