The Unique Risks of Chinese Stocks

The Sword of Damocles and equity investing

China has some of the most innovative companies in the world. Tencent in particular might be one of the best capital allocators of any company in history. Unfortunately for investors who are not Chinese citizens the civic laws of China appear to be pretty clear that they ban foreign ownership in a variety of industries. Wall Street has never met an issuance fee it didn’t like and worked hard to come up with structures to get around this called Variable Interest Entities.

As always this is not investment or legal advice.

I am simply documenting my thoughts publicly for my own records and to get feedback. It appears a few things are true:

Non-Chinese Investors are buying companies in the Cayman Islands with the same name as the Chinese mainland company

The Cayman entity owns no direct equity in the mainland company

There are agreements to profit share with the VIE and the mainland company but these might be both illegal and have been shown unenforceable multiple times in practice

While the Cayman and China entities are legally two separate companies, the SEC allows the VIE to report the balance sheet and income as if it was the mainland company but its claims to those assets and incomes appears to be weak at best, nonexistent in practice

The spirit of the VIE seems aggressive if not outright illegal under Chinese law

Even if you could buy the mainland shares directly the accounting and properly law standards of China are significantly lacking

Let's look at each of these individually.

Non-Chinese Investors are buying companies in the Cayman Islands with the same name as the Chinese mainland company

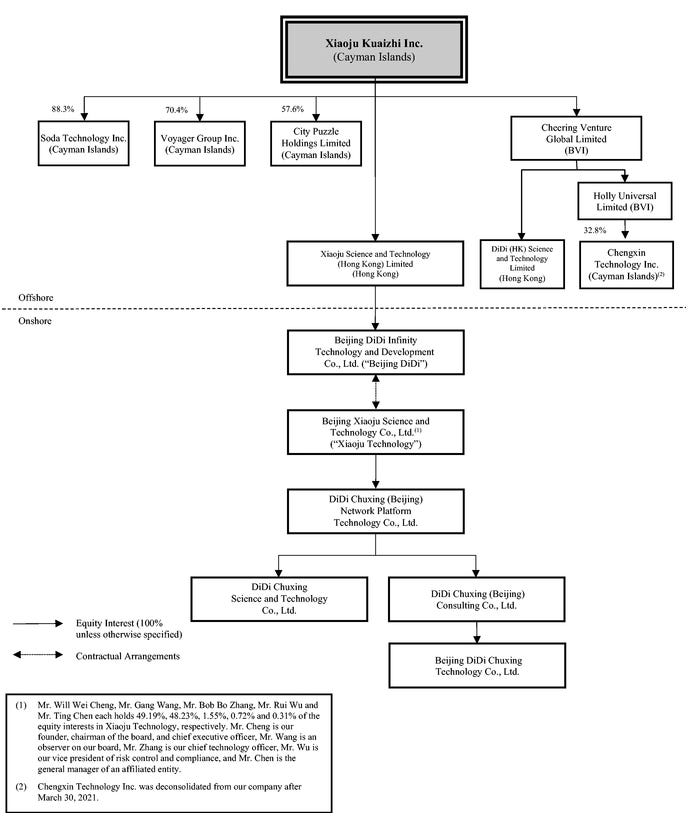

From Didi’s F1:

I personally am not smart enough to understand each part of this corporate structure or understand what the US listed Cayman Didi owns relative to the Beijing Didi entity. This level of convolution is not uncommon in the world of Variable Interest Entities.

What is clear is an investor would be buying some portion of a Cayman Island shell company which owns or has contractual relationships with a variety of other Cayman and Hong Kong entities which owns or has some sort of contractual relationship with the onshore entities.

The more general form of this VIE structure is below:

Source: Council of Institutional Investors

2. The Cayman entity owns no equity portion of the mainland company

“In the VIE structure, American stockholders don’t own the Chinese company. They just own a company that has some contracts that are supposed to mimic what it would look like to own the Chinese company. You’re not buying stock in Alibaba when you buy Alibaba on the NYSE. You’re buying a holding company called Alibaba Holdings registered in the Cayman Islands with a claim on some of Alibaba’s profits but no actual ownership stake. You don’t own shares in the real Alibaba and you don’t get a vote in how Alibaba is run, although you do get to share in Alibaba’s profits.” - The Diplomat

“The VIE structure could be deemed to contravene Chinese laws that restrict foreign investment in strategically sensitive industries. VIEs operate using contractual arrangements rather than direct ownership, leaving foreign investors without the rights to residual profits or control over the company’s management that they would otherwise enjoy through equity Ownership.” - Council of Institutional Investors

3. There are agreements to profit share with the VIE and the mainland company but these might be both illegal and have been shown unenforceable multiple times in practice

“Frankly we do not think that the SEC (US), the FCA (UK) and ESMA (Europe) have done what they should do when it comes to VIEs and regulating them. There is little to nothing made of the fact that shareholders in these VIEs own no real assets and have no legal recourse should the Chinese decide to void the whole situation, or the Chinese parent company decide to move assets elsewhere (as with Alipay).”- GCI Investors

What were the practical consequences of this for Shareholders? Let’s look at Yahoo and Alipay.

“Yahoo is apparently losing the faith of some of its investors as its dispute with China’s Alibaba drags on: Greenlight Capital head David Einhorn has unloaded his stake in Yahoo just a few months after acquiring a sizable holding in the company. And Einhorn’s reason for getting out of Yahoo is nothing other than Alibaba’s transfer of online payment service AliPay to a new entity with full Chinese ownership.” - Yahoo loses major investor Einhorn over Alipay dispute

“Internet giant Yahoo and China’s Alibaba have, in conjunction with Japan’s Softbank, reached an agreement (PDF) in their lingering dispute over the Alipay online payment service. Under the agreement, Alibaba will receive no less than $2 billion and no more than $6 million when (and if) Alipay experiences a “liquidity event” like being sold or going public. The exact amount will be 37.5 percent of Alipay’s value at the time—and, of course, with Yahoo being a 43 percent stakeholder in Alibaba, the American company will reap some of the rewards.” - Yahoo, Alibaba, and Softbank reach agreement on Alipay

Note two things, the above quote by Yahoo has a typo, it appears they mean up to 6 billion, which at the valuation Ant Group attempted to go public at last year would be 2% of Ant Group / Alipay. Significantly less than the 126.85 billion or 43% they would likely have been entitled to under common law and a more normal shareholder rights structure.

“Naturally, Yahoo shareholders were furious, and the CEO of Yahoo was fired shortly afterwards.” - GCI Investors

Finally Yahoo still has not received any money from a liquidity event as the IPO was blocked by regulators. Other investors in the private Ant Group such as Fidelity have marked down their shares by about 50% in response to the regulatory uncertainty:

“The Boston-based asset manager, which was among an elite group of global investors that bought into Ant three years ago, marked Ant shares in several of its funds at prices that implied a $144 billion valuation for the company at the end of February, according to regulatory filings.

The prices were below what Fidelity originally paid for Ant’s shares, suggesting the firm believes it could incur a loss on the investment.” - WSJ

4. They are legally two separate companies, the SEC allows the VIE to report the balance sheet and income as if it was the mainland company but its claims to those assets and incomes appears to be weak at best, nonexistent in practice

“Investors are also let down the by global accounting standards of both US GAAP and the IFRS. Current accounting standards make shares in the VIEs appear to investors as if they are in fact ownership of the Chinese company. Under both US GAAP and IFRS, VIEs are allowed to consolidate the financial statements of their domestic counterpart into their own reporting. So, when any prospective investor looks up Alibaba stock (which is of course the VIE), they see the balance sheet and income statement of the Real Alibaba, despite the fact that what they’re actually buying is a Cayman’s shell company with no real assets and no legal claim to the assets or income streams of the Real Alibaba. We believe that presenting the information in this way is hugely misleading.” - GCI Investors

5. The spirit of the VIE seems aggressive if not outright illegal under Chinese law

“U.S. investors have invested over $70 billion in Chinese companies. Many of those investments—by some estimates most—are illegal under Chinese law. Some of China’s largest companies, including nearly half of the Chinese companies listed on U.S. stock exchanges, are participants in this scheme to facilitate illegal investment. The illegal status of these investments is abused by corporate insiders in China who steal assets owned by U.S. shareholders with impunity, and there is a constant threat that the Chinese government may crack down on these illegal investments at any time. The situation is unsustainable, and the threats posed to U.S. investors and the global economy are colossal. The mechanism enabling this dysfunctional system of international investing—the “variable interest entity” corporate structure—is at the root of the problem and must be replaced. This can be accomplished through a robust U.S.-China bilateral investment treaty, which will allow the U.S. and Chinese governments to fix this broken system before more U.S. investor money is lost and the global economy is placed in greater jeopardy.” - China’s Variable Interest Entity Problem: How Americans Have Illegally Invested Billions in China and How to Fix It

6. Even if you could buy the mainland shares directly the accounting and properly law standards of China are significantly lacking

Luckin coffee proceeded to fall over 80%.

This is not a terribly uncommon phenomenon:

“In total, regulators suspended 46 IPOs and bond offerings, based on filings made at the Shanghai and Shenzhen stock exchanges, including Shanghai’s Star Market, as of Monday, according to the South China Morning Post. The reason: these companies had chosen Ruihua Certified Public Accountants as their auditors.

Ruihua, the second largest audit firm in China, has been embroiled in scandals involving large amounts of fake data, including fake cash, on its clients’ books. The fakeness of this cash became obvious when these companies defaulted on debt that they could have easily serviced with the cash they claimed to have on their books but didn’t. And Ruihua had just signed off on those fake books.” - Wolfstreet

“…Our ability to promote and enforce these standards in emerging markets is limited and is significantly dependent on the actions of local authorities—which, in turn, are constrained by national policy considerations in those countries. As a result, in many emerging markets, including China, there is substantially greater risk that disclosures will be incomplete or misleading and, in the event of investor harm, substantially less access to recourse, in comparison to U.S. domestic companies.” - Public Statement by SEC Chairman Jay Clayton “Emerging Market Investments Entail Significant Disclosure, Financial Reporting and Other Risks; Remedies are Limited”.

What are the implications of this?

“Such a complex, deceptive practice as investing through the Chinese VIE structure naturally comes with significant risks beyond those associated with ordinary investing. There are two potential hazards in particular that raise serious concerns for U.S. investors: (1) the potential for insider misappropriation that leaves the company with no legal recourse; and (2) the possibility of a government crackdown on the VIE scheme.” - China’s Variable Interest Entity Problem: How Americans Have Illegally Invested Billions in China and How to Fix It

To me it appears investing in a VIE is a 3 pronged bet on things outside the realm of typical stock investing. The first is that the founder of the company only acts in the best interest of the VIE shareholders. We have already seen this is untrue for even some of the best Chinese companies. The second bet is that China does not crack down on VIEs, which appear to be obviously illegal under Chinese law. This type of risk is Nassim Taleb’s Turkey where 1000 days of the Turkey getting fed does not imply that the Turkey will not be eaten on day 1001.

The final bet investors are making is that not only will China avoid a crack down on the VIE structure, but they will also open up geopolitically sensitive areas of their economy to foreign investment, and grandfather in the current investors in Cayman Island entities to Chinese equity ownership. This seems significantly unlikely to me and I am not enough of an expert to dig deeper when there are alternative opportunities with greater simplicity.

Due to these factors, investments in any company or fund with exposure to the VIE structure is unacceptable to me personally and I exited the already very small exposures I currently have.

Disclaimer

In no event will Prdctnomics or any of the Prdctnomics parties be liable to you, whether in contract or tort, for any direct, special, indirect, consequential, or incidental damages or any other damages of any kind even if Prdctnomics or any other such party has been advised of the possibility thereof.

The writer’s opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by Prdctnomics constitutes an investment recommendation, nor should any data or Content published by Prdctnomics be relied upon for any investment activities.

Prdctnomics strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.