The race to become the WeChat of the West

Imagine if the demand aggregators of today aggregated... everything.

Join me as we look at the contenders to become the dominant “super app” and primary digital wallet of the world ex-China. Here I believe Tencent has leapfrogged western tech companies which are thus far only targeting verticals of what WeChat is capable of. This is even more impressive scaled to their over 800 million monthly active users. I will only be covering the consumer side of these potential “super apps” and walking through product mocks and imagery making this post a more visual experience compared to my usual articles.

I will try to stay away from predictions and focus on the products as they are but I am curious how relevant banks will remain in the future as Fintech both commoditizes and disrupts them. If I did product management for a bank I would be focusing on how we can reduce user frictions, provide tremendous value with little to no fees, and do so wrapped in gorgeous user experiences simply as a matter of survival.

All of these companies have the potential to aggregate demand and become the front end to what are currently our banking, shopping, spending, dining, and transportation services. If anything they are not ambitious enough and should take inspiration for what Tencent has accomplished with WeChat.

All imagery is from the respective company’s marketing materials or investor presentations.

PayPal

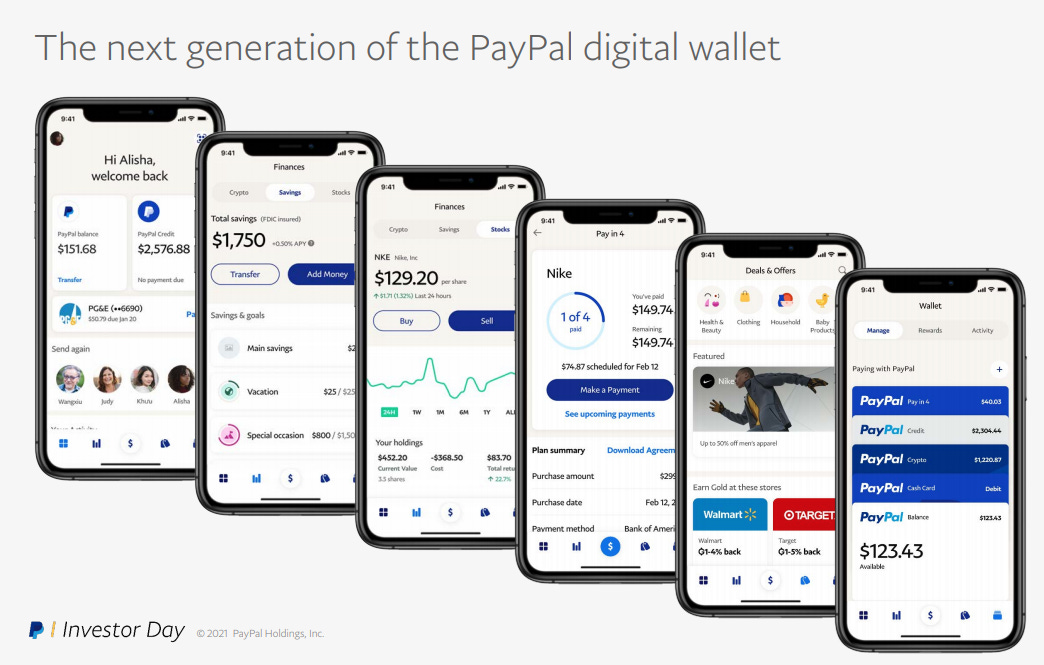

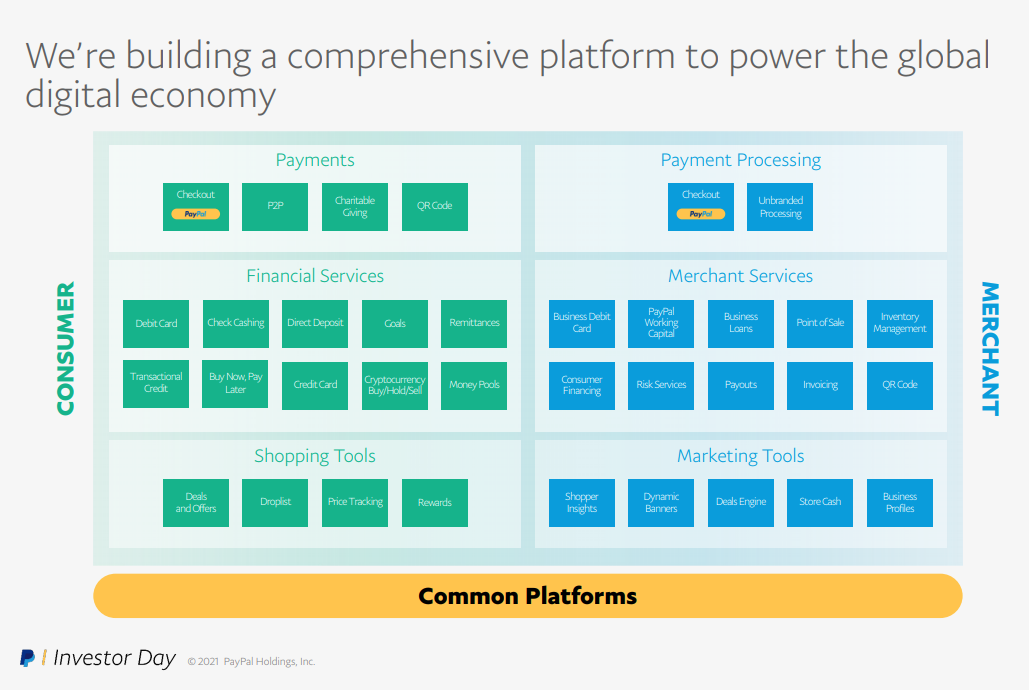

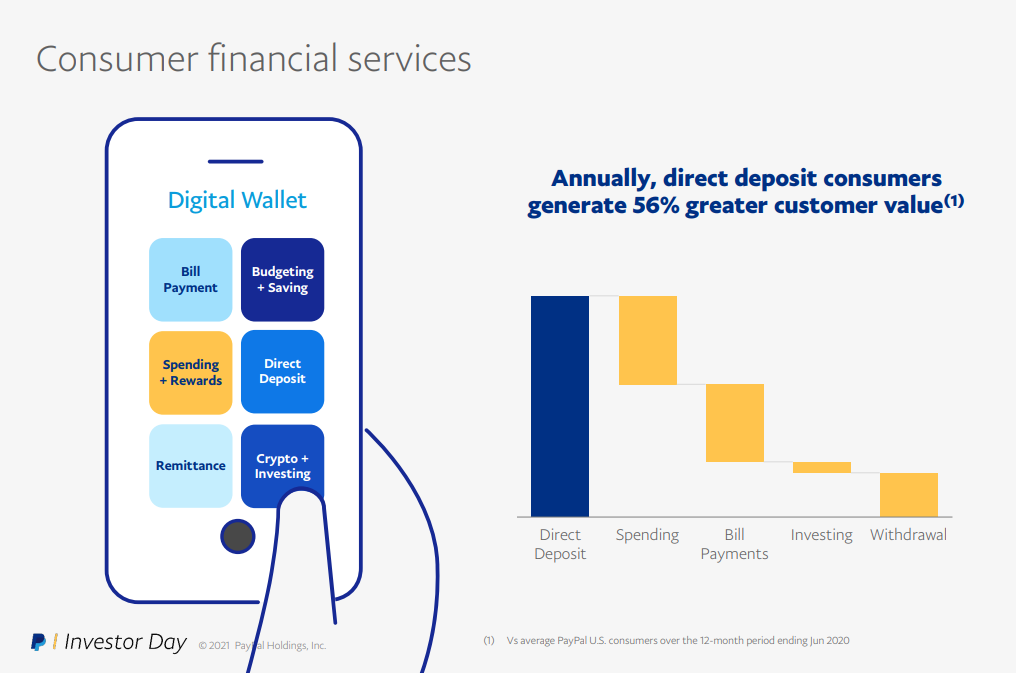

PayPal is going to be targeting 3 areas of consumer finance.

Payments with checkout, p2p, charitable giving, and QR code based payments.

Integrating financial services like around spending, saving, credit, and cryptocurrency.

Shopping tools and portals directly in the PayPal experience.

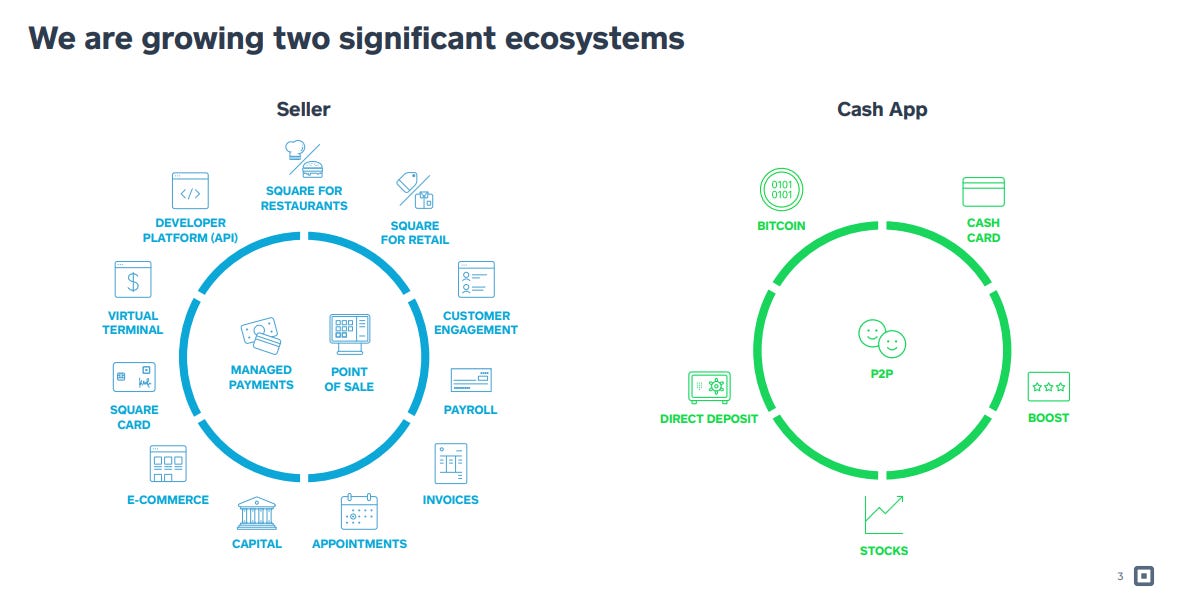

Square

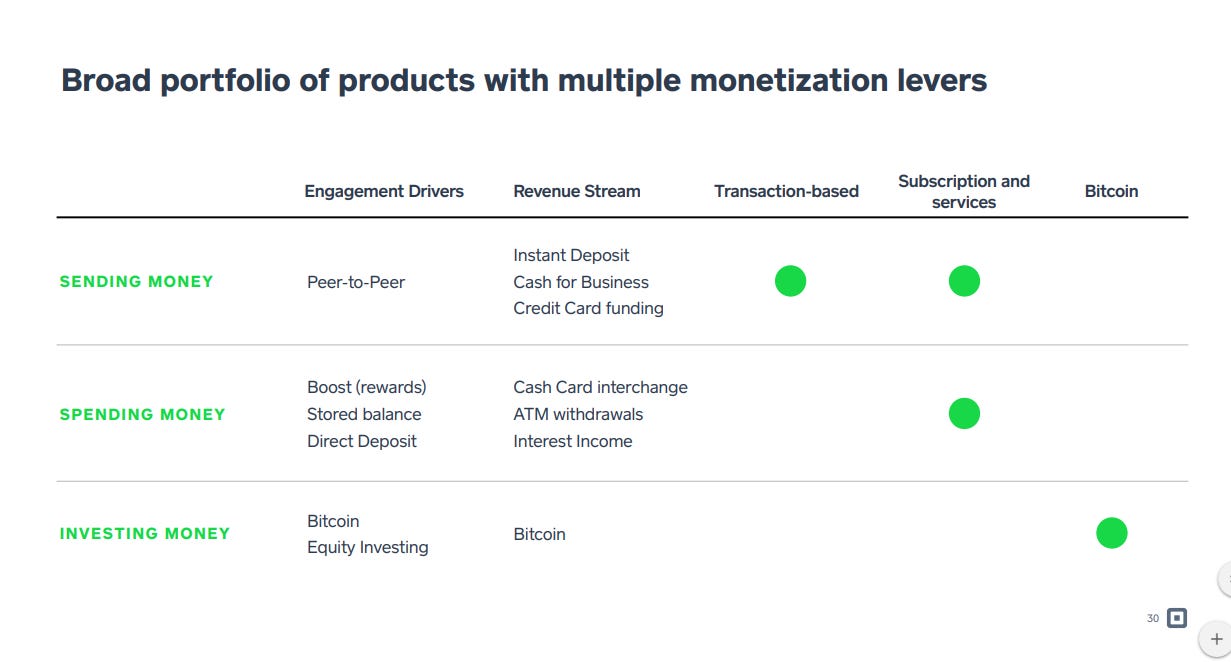

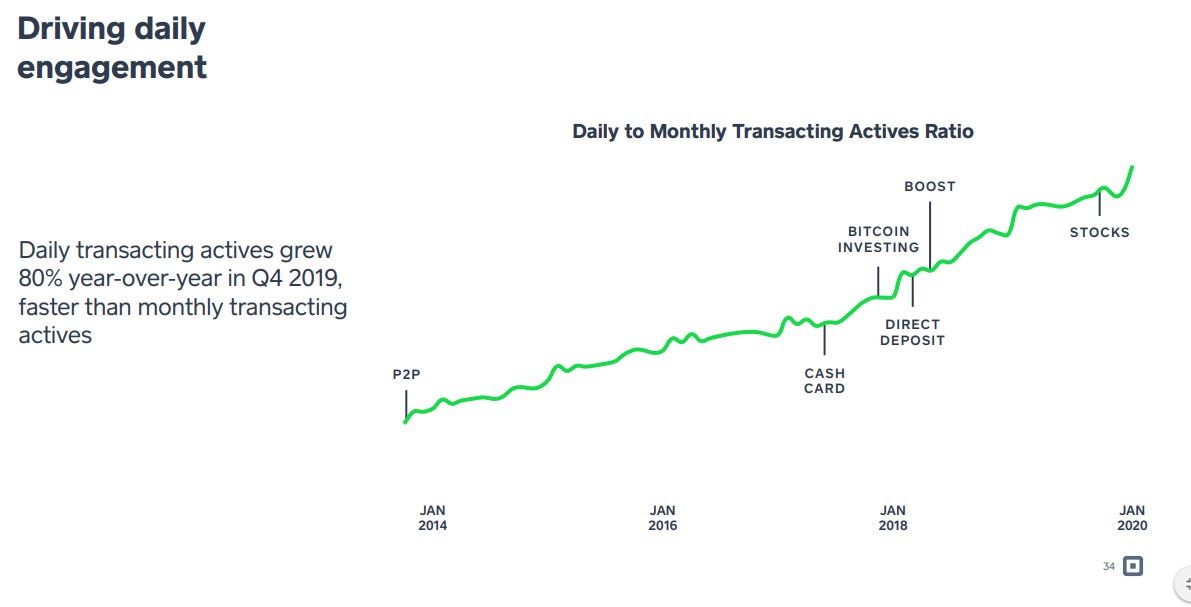

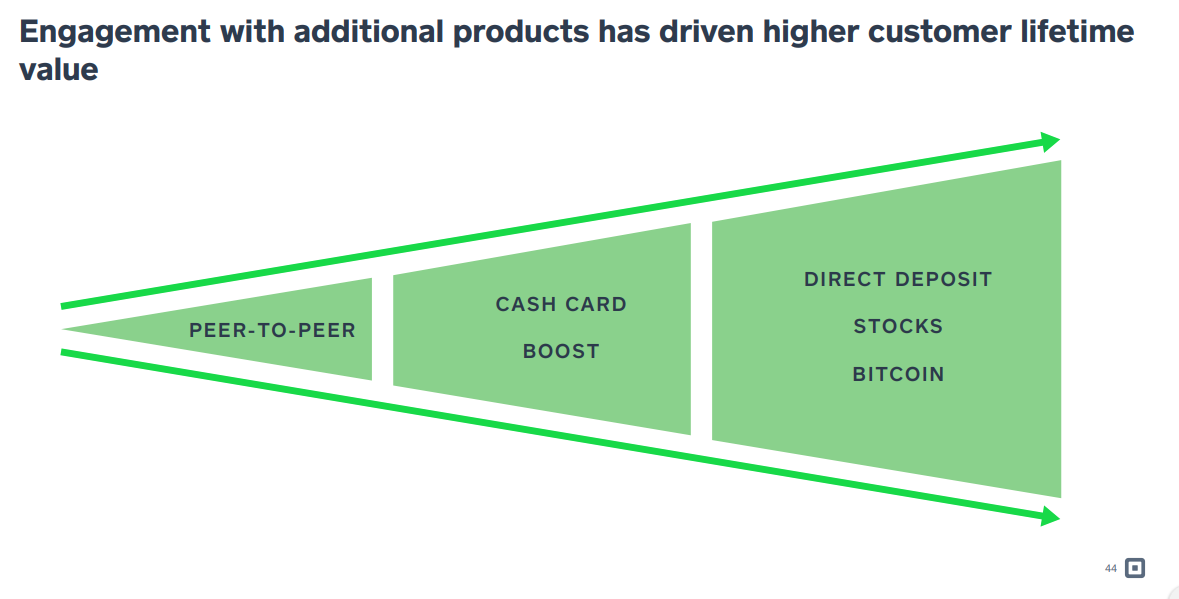

Square’s digital wallet is the cash app, one of the most exciting and complete financial products outside of China. Cash app provides direct deposit, bitcoin investing, stock investing, an alternative to payday loans, and a debit card. Anecdotally many people I know in their teens through their 20s use Cash App instead of both banks and brokerages.

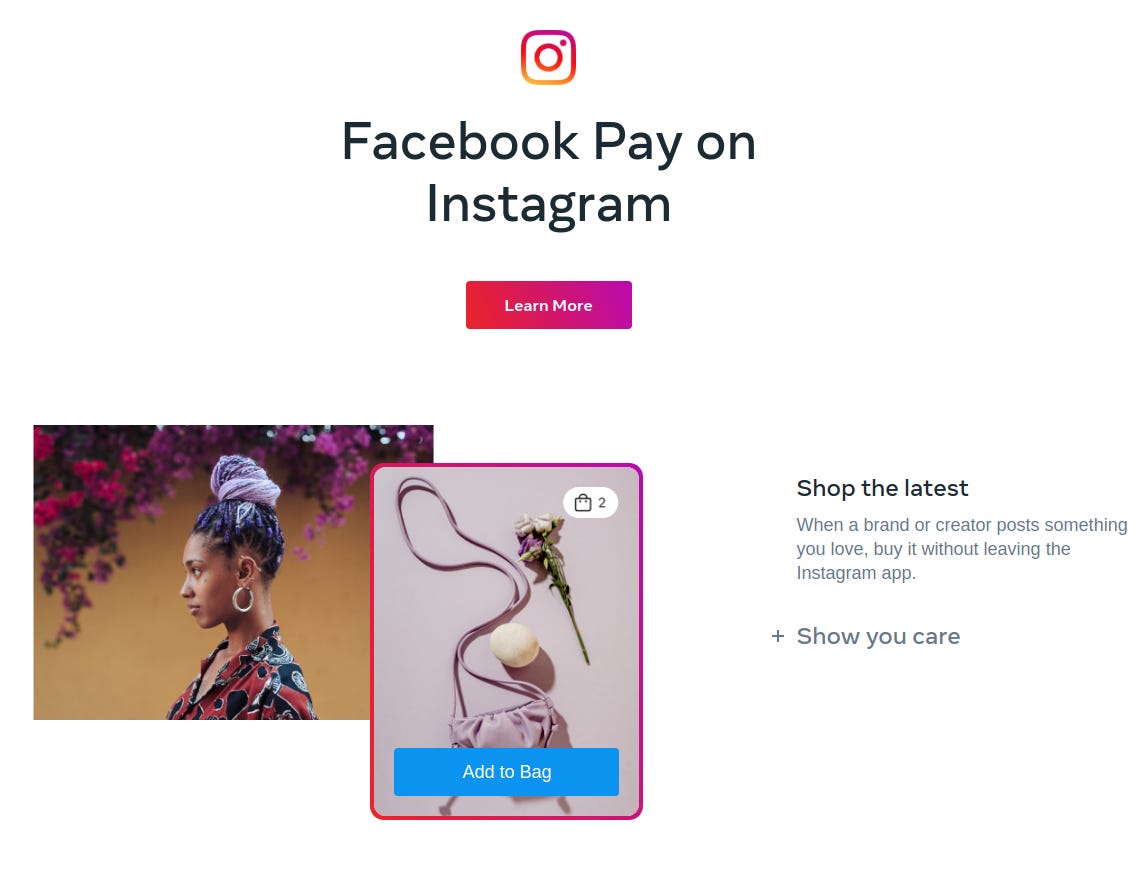

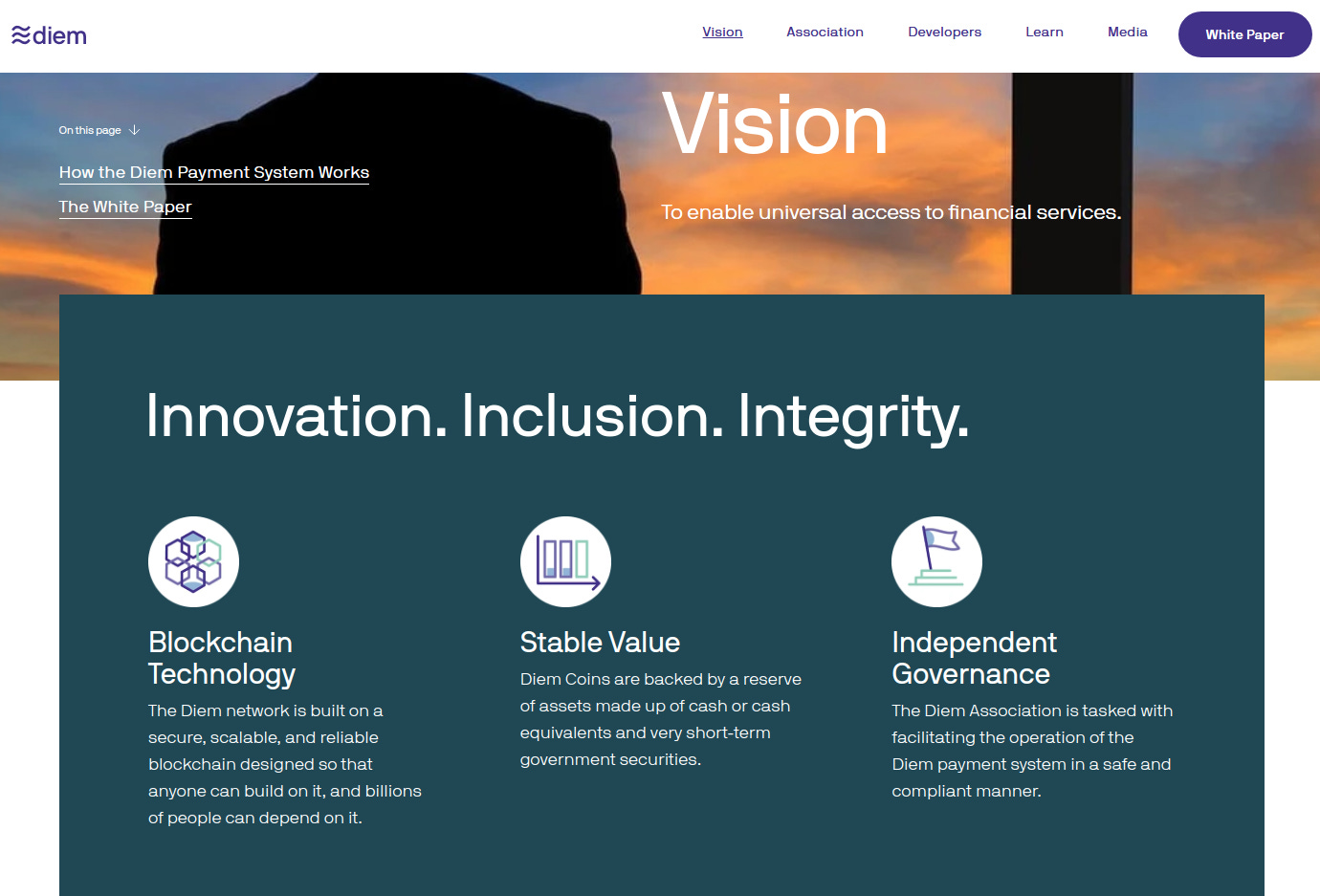

Facebook

Facebook has been late to this arena but by virtue of their market position and one of the largest user bases of any company in human history I suspect they have a strong shot at becoming the west’s super app. Payments and e-commerce are being thoughtfully built into every Facebook experience, all of which will also benefit from existing network effects. There is also the free optionality of being the potential payment layer for virtual reality community and games. Finally Facebook has shown tremendous ambition with the plans to launch their own cryptocurrencies / stable coins.

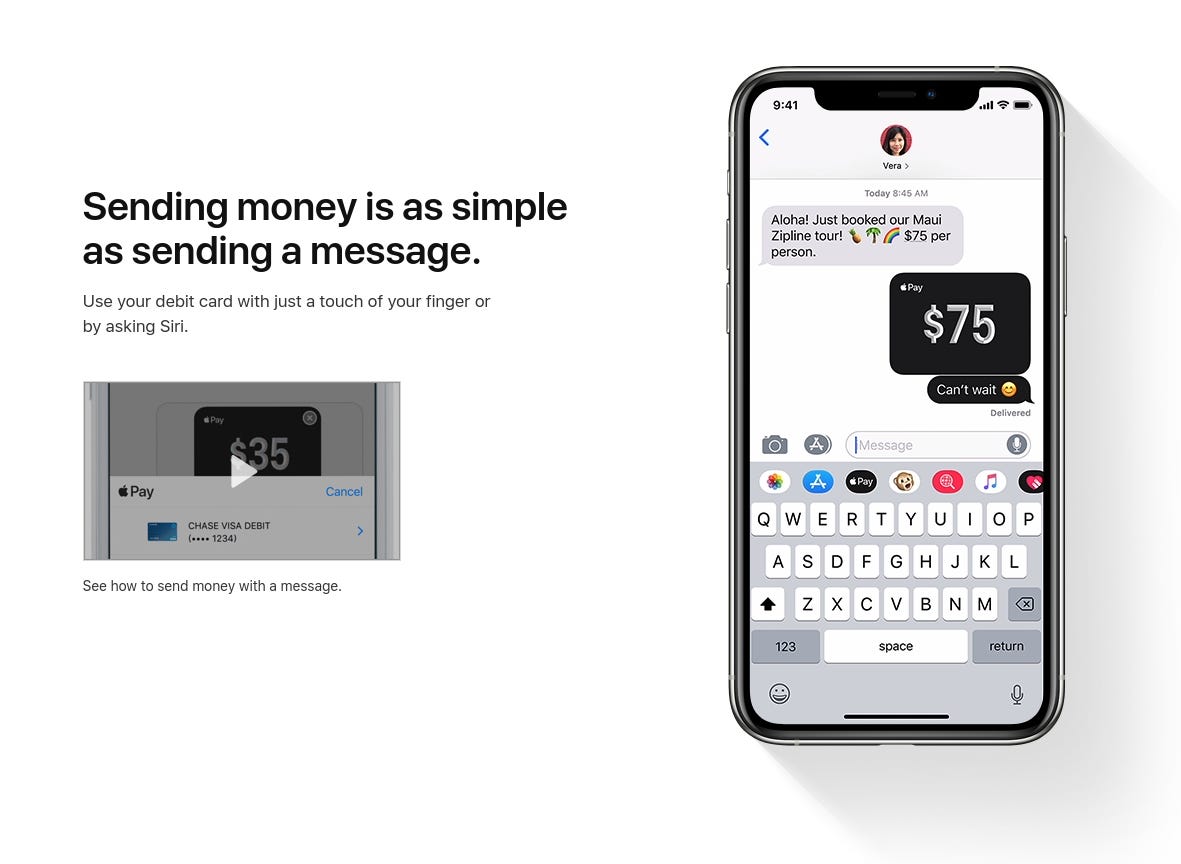

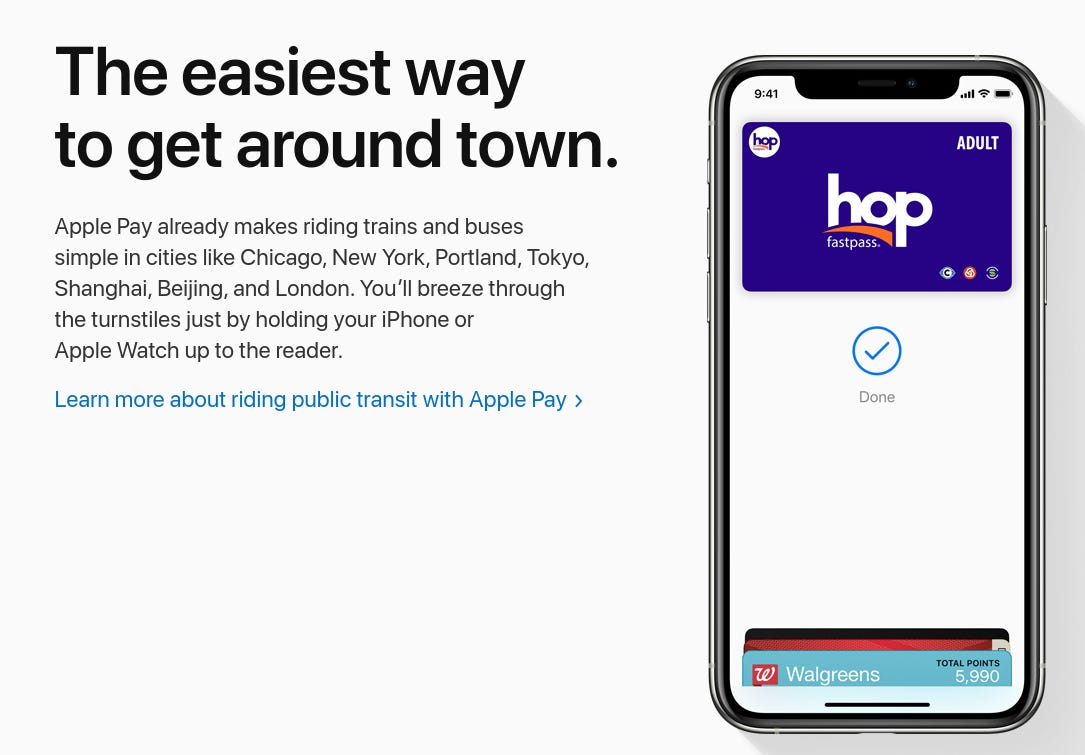

Apple

Apple’s product focus, hardware install base, and ownership of iMessage give it natural distribution points for future digital wallet innovations. I look forward to seeing continued innovation here.

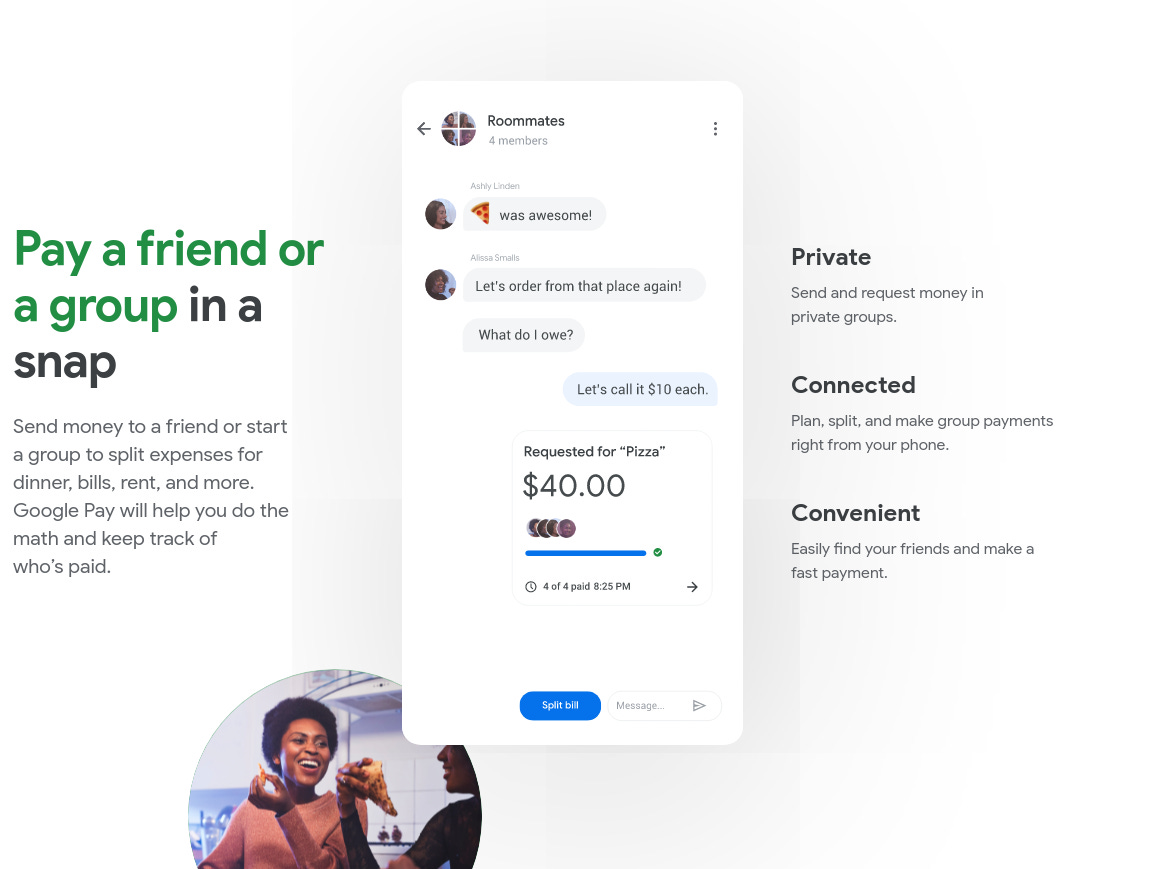

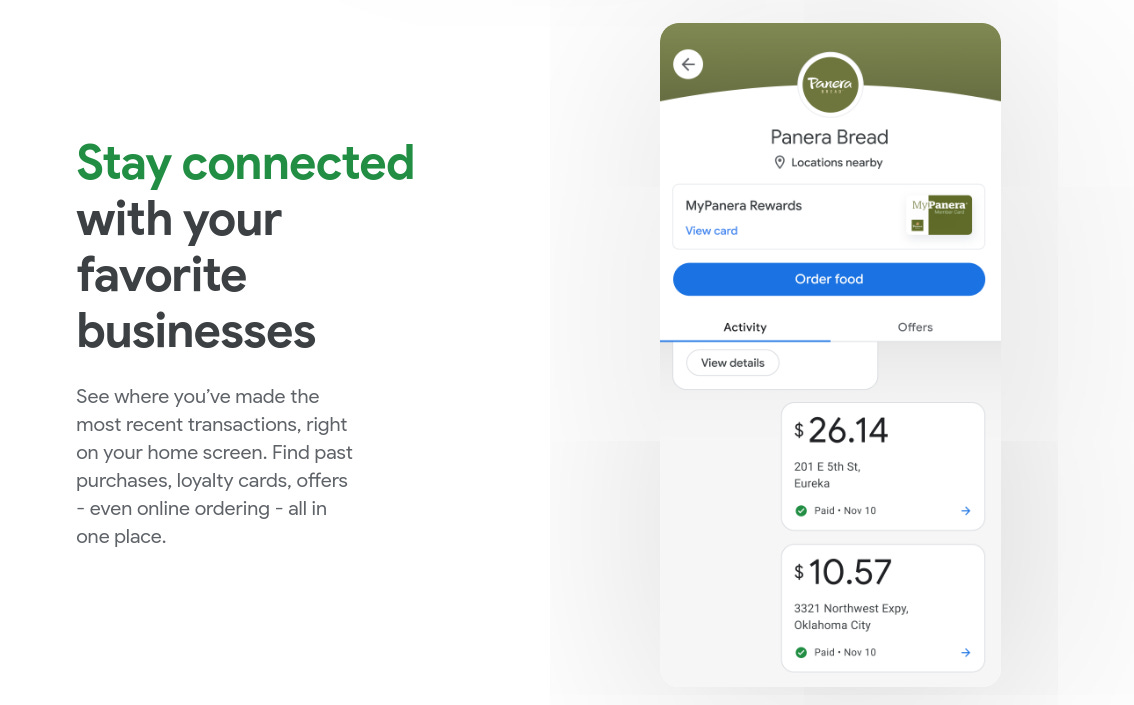

Google

As with Apple, Google has a huge install base in the Android OS, and potential for deeper payment integration with the Chrome web browser. Google’s product portfolio would lend itself well to the “super app” concept.

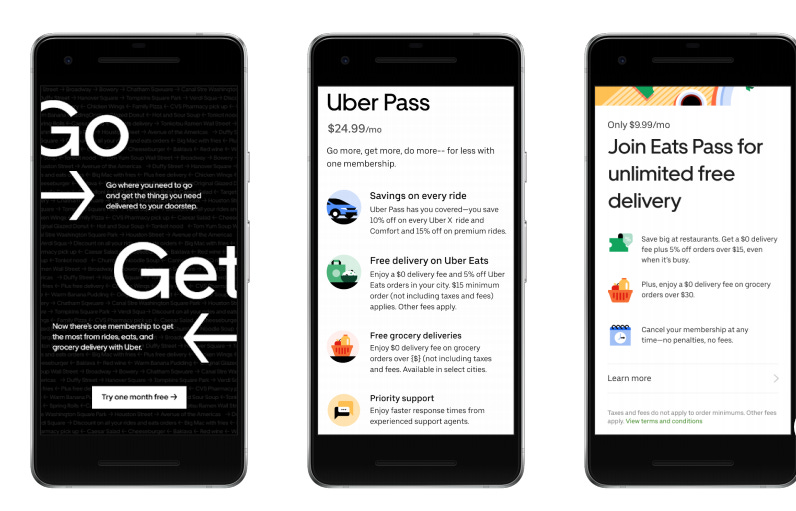

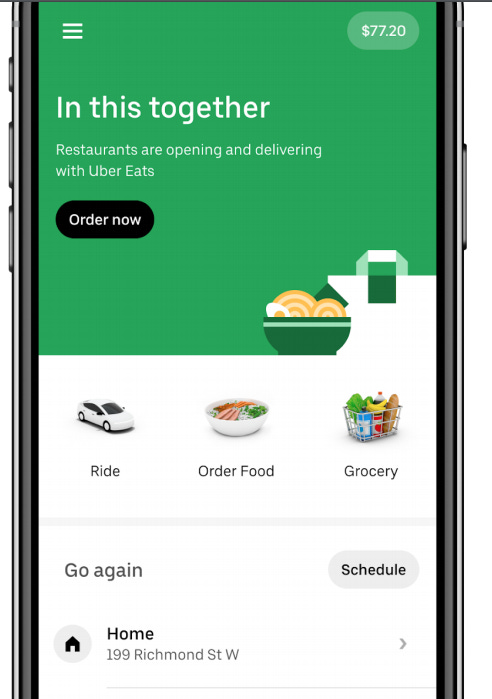

Uber

Finally an honorable mention for Uber. Uber is evolving into a logistics focused super app, and the potential to aggregate increasing percentages of demand for moving people and things is obvious to me.

Other

What is missing from the above? DoorDash, Lyft, and more single vertical focused players could become hybrid logistics and fintech offerings. API driven finance is in its infancy and just as Wealthfront has commoditized banking with their savings products brokerages will likely just be the back end custodians of your chosen super app. The TAM for all of these products is absolutely massive individually, combined they could be the growth engine for these or new products for many years to come. The other wild card here is if any of these companies are able to disrupt the current payment rails of VISA and MasterCard.

It is going to be an interesting decade.

Disclaimer

In no event will Prdctnomics or any of the Prdctnomics parties be liable to you, whether in contract or tort, for any direct, special, indirect, consequential, or incidental damages or any other damages of any kind even if Prdctnomics or any other such party has been advised of the possibility thereof.

The writer’s opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by Prdctnomics constitutes an investment recommendation, nor should any data or Content published by Prdctnomics be relied upon for any investment activities.

Prdctnomics strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.