Platforms and Marketplaces in 2020

Damn it feels good to be a platform

As always if you like this and would like to see more similar content please subscribe, share, and like. Thanks!

Looking back at 2020 it was truly the year of the technology platform. Although a huge amount of demand was no doubt pulled forward due to the continuing pandemic various technology platforms shifted from being luxuries to being necessities for staying in touch, delivering food, shopping, investing, and staying entertained.

Rather than remove traditional gatekeepers, platforms have replaced them. We have seen reintermediation rather than disintermediation. - Sparkline Capital

What is a platform

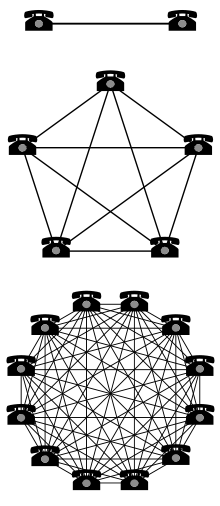

I’d like to quickly define what a platform is as described here. A platform is any business or technology where it’s users benefit from network effects. Specifically this means that users of the product derive more value from the product the more users it has. Telephone networks were the original example of this hence “network effects”.

Network effects also known as demand-side economies of scale should not be confused with traditional supply side economies of scale which typically is shown as decreased costs of production as production scales.

Network effects can be direct such as with telephone users where additional users are the value, or indirect where interdependent users of a complimentary product drive demand of a different product. Examples of indirect network effects could be hardware becoming more valuable as a result of new software use cases. GPUs and non-graphic computing use cases come to mind such as cryptocurrency mining or machine learning workloads.

Network effects can easily become positive feedback loops where more users and content makes a network more valuable to join which causes more people to join resulting in more users and content in a virtuous cycle.

The Platform Economy

Sparkline Capital has done an amazing job quantifying the impact of platform companies on the investment universe. Having read all of their research over the last couple weeks I’ve been consistently impressed and am excited to share some of their findings.

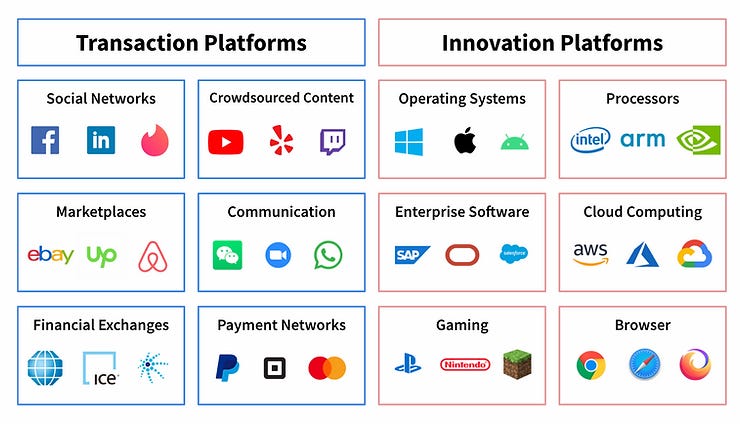

They split platforms into two categories, transaction platforms and innovation platforms. Transaction platforms are intermediaries for direct exchanges or transactions (Facebook, AirBNB, VISA, YouTube, Zoom being examples). Innovation platforms are platforms that provide a tech foundation that other firms develop complementary innovations on. Examples include operating systems, semiconductors, cloud computing, gaming, and web browsers. Admittedly I could see some companies like Amazon falling into both categories.

The value of any platform to its users will be “a nonlinear function of the size of their networks”. Digital technology and the internet is making scale never before possible in human history increasingly common and thus platforms are becoming an ever greater part of the economy and our lives.

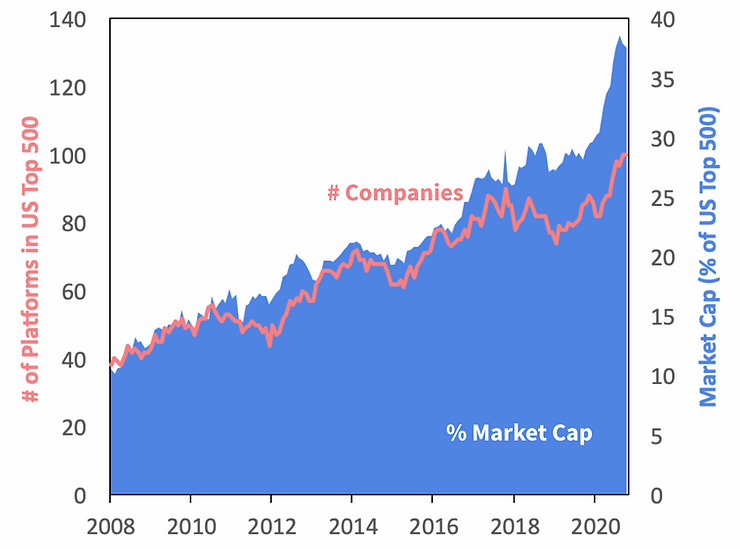

Platforms are an ever increasing percentage of the US economy

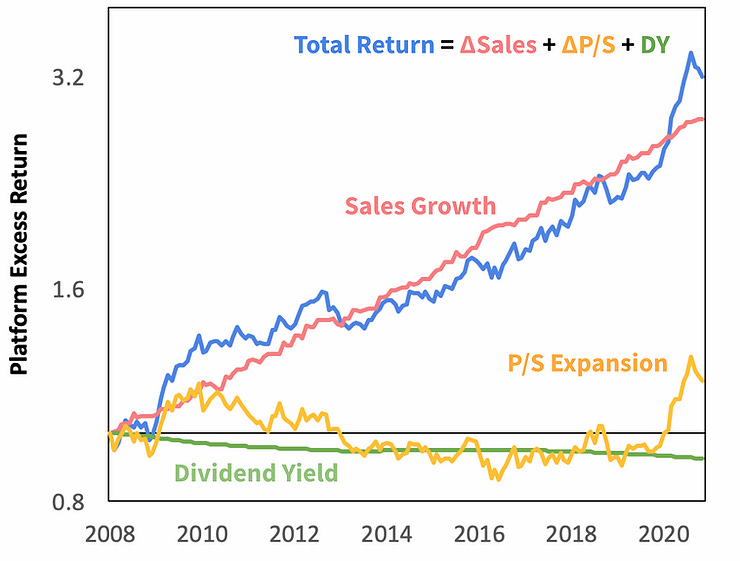

Additionally platforms have outgrown the general stock market by an increasing amount overtime.

If this is because platforms were previously undervalued or not remains to be seen but obviously price to sales expansion is quite rampant in popular companies today.

Sparkline goes on to examine the under what conditions platforms create value, why platforms tend towards natural monopolies, and investment specific information regarding platforms.

When considering both private and public investments the potential of that investment to mature into a thriving platform is top of mind for me.

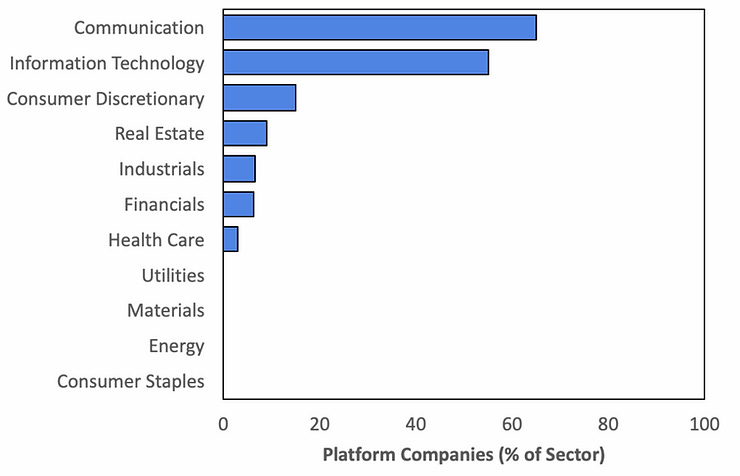

So far platforms have primarily been successful in capital light communication and information technology sectors but last mile logistics, real estate, and many untapped sectors which may become digitized as IoT mainstreams are current and future opportunities for platforms respectively.

You can read the entire Sparkline Capital article on platforms here.

E-Commerce in 2020

The Marketplaces Year In Review is worth a read in it’s entirety but a couple highlights below.

“2020 was the best year for e-commerce marketplaces in over a decade. E-commerce growth had a step change, and marketplaces captured most of it. In aggregate, it was the most successful year for sellers and brands that transact through them, too. The Year in Review looks at the state of marketplaces and describes the most important trends.” - Marketplace Pulse

Source: marketplacepulse.com

Etsy

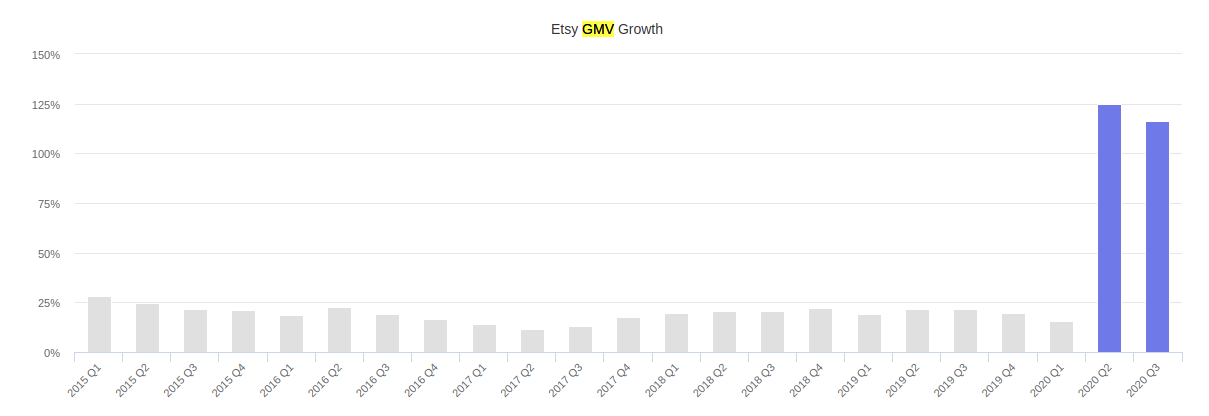

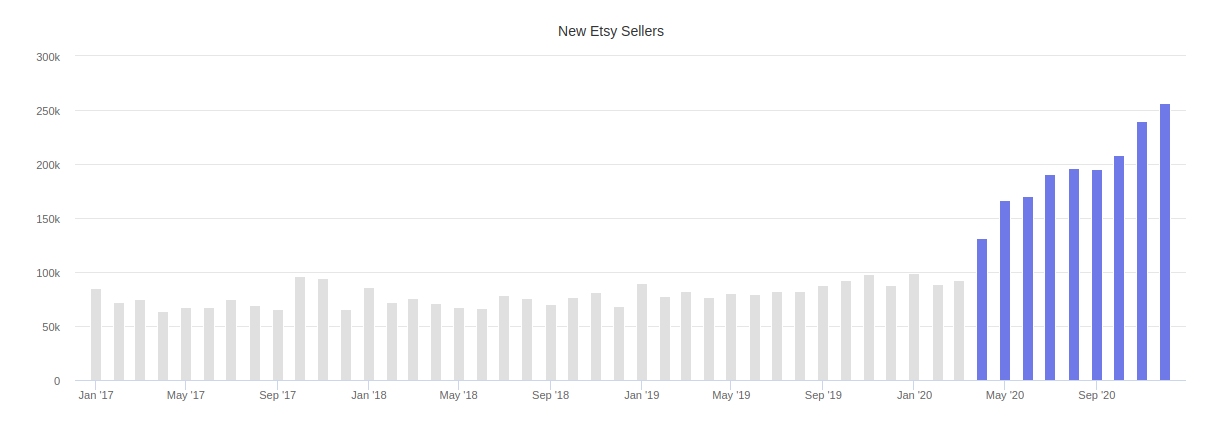

Etsy is a standout winner in the US e-commerce arena nearly doubling it’s gross merchandise volume and attracting massive demand and subsequently new sellers to the platform.

“On April 3rd, the same day the White House announced guidelines that Americans should wear masks outside of the home, Etsy sent a push notification to every seller: “Calling all sellers. Start making face masks.” Hundreds of thousands of existing and new sellers started selling face masks.

“I woke up to discover it was suddenly like Cyber Monday,” Etsy’s CEO Josh Silverman told the Financial Times. “But everyone in the world wanted only one product.” That product was face masks.” - Marketplace Pulse

Source: marketplacepulse.com

Source: marketplacepulse.com

Etsy’s total catalog size increased from ~60M to 80M products in 2020.

Amazon

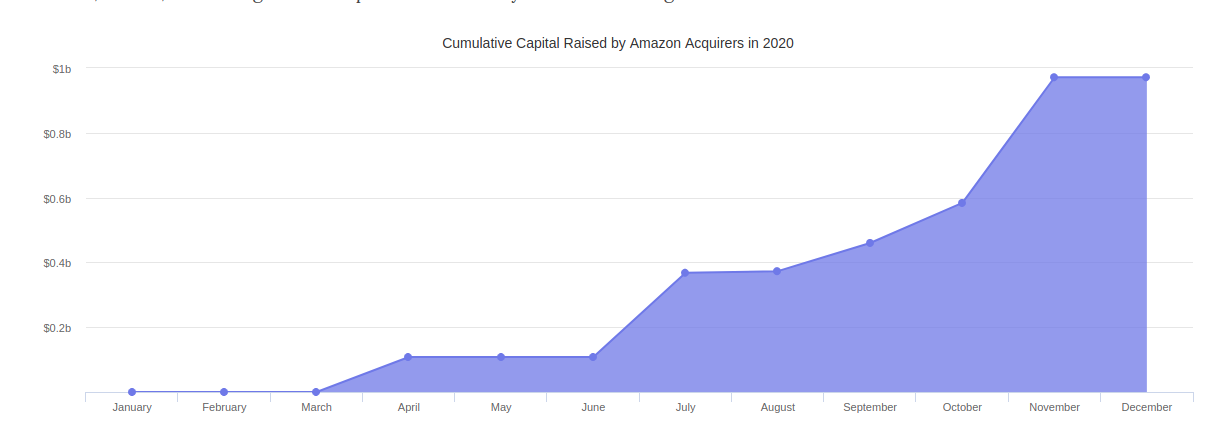

In 2020 Amazon 3P sales increased 47% while 1P sales increased 35%, resulting in 62% of AMZN’s global merchandise sales being fulfilled the third party marketplace.

Over this time over 1 billion dollars was deployed by firms buying up 3P sellers and their brands on Amazon.

Source: marketplacepulse.com

It is very interesting to see dollars move from attempting to compete with Amazon’s ecosystem to just buying companies that are part of it. This is part of a broader micro private equity trend that I expect to continue in a big way across most platform businesses.

To read the rest of the deep dive on marketplaces once again check out Marketplaces Year In Review for 2020.

Whats next for 2021

I suspect platforms will continue to become increasingly impactful on the lives of the average internet user, and due to their concentration of power will also be increasingly scrutinized by regulators and politicians for real and imagined harms. As an early adopter and investor I will be keeping an eye out for clever problem solving by platforms in their infancy as well as continue to observe emerging and international platforms which have already hit their growth stride.

Are you building or investing in a platform you’re excited about? Please share it in the comments below 👇

Disclaimer

In no event will Prdctnomics or any of the Prdctnomics parties be liable to you, whether in contract or tort, for any direct, special, indirect, consequential, or incidental damages or any other damages of any kind even if Prdctnomics or any other such party has been advised of the possibility thereof.

The writer’s opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by Prdctnomics constitutes an investment recommendation, nor should any data or Content published by Prdctnomics be relied upon for any investment activities.

Prdctnomics strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.