The Philosophy of Fundsmith

Part 3 of my investing mental models

If you’re new to the “How I invest series” this is Part 3. I’m writing this to document the mental models I’ve gained from 3 videos that were more valuable than my entire university economics education was for equity investing.

Part 1: Competition is for Losers with Peter Thiel

Part 2: The Little Book that Builds Wealth with Pat Dorsey

Part 3: The Philosophy of Fundsmith

Disclaimer

In no event will Prdctnomics or any of the Prdctnomics parties be liable to you, whether in contract or tort, for any direct, special, indirect, consequential, or incidental damages or any other damages of any kind even if Prdctnomics or any other such party has been advised of the possibility thereof.

The writer’s opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by Prdctnomics constitutes an investment recommendation, nor should any data or Content published by Prdctnomics be relied upon for any investment activities.

Prdctnomics strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Today we will review legendary investor Terry Smith’s investor philosophies. Fundsmith was founded in 2010 by Terry Smith and he has grown AUM to £26bn as of 2019. He believes in rigorous in house, bottom up analysis of individual companies when investing and their portfolio size is under 30 stocks. Their strategy is relatively straightforward and has been embraced by many Growth At Reasonable Price investors (GARP) as well as investors looking for compounders.

Investment Strategy

Invest in good companies

Don’t overpay

Do nothing

What is a good company?

A good company is one that has:

High returns on operating capital employed in cash

Growth driven from reinvestment of their cash flows at high rates of return

Make money from a large number of everyday, small ticket, repeat, predictable transactions

Able to protect returns against competition

Resilient to change, particularly to technological innovation

Operating in sectors with intangible advantages: brands, distribution, installed base, franchisers

High returns on operating capital

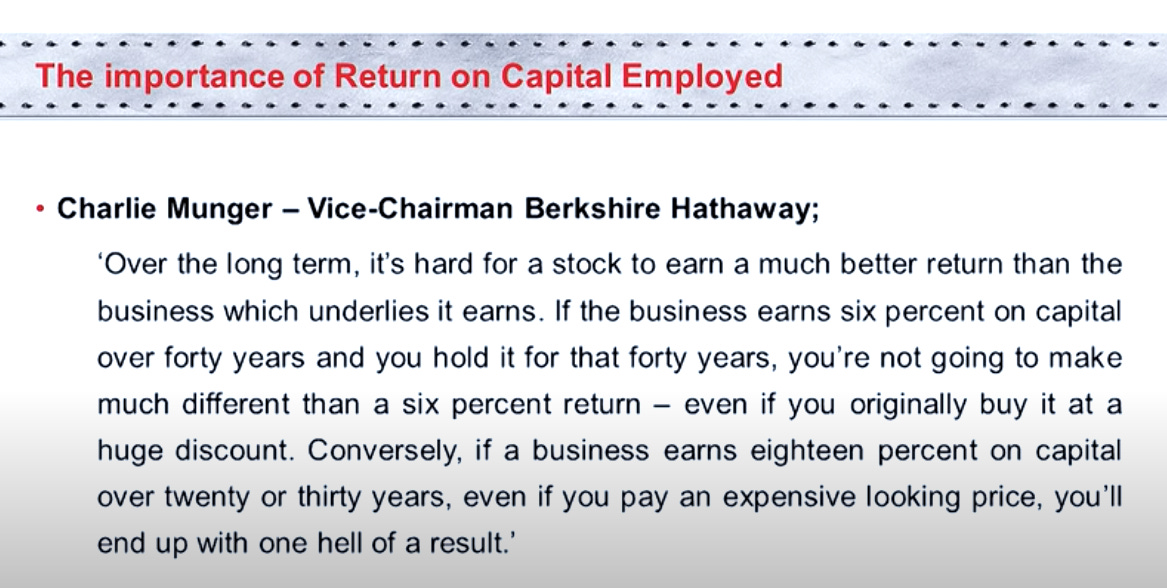

If a company makes more than its cost of capital over time it grows capital, if it makes a rate lower than its cost of capital it loses money. Figuring out cost of capital is a challenging estimate but if you’re investing exclusively in companies with very high returns on invested capital it’s exact value becomes less important.

Most investors, investor literature, and investing newsletters focus on gains in earnings per share and not the earnings rate of equity on capital employed.

“This is a machine for losing money”.

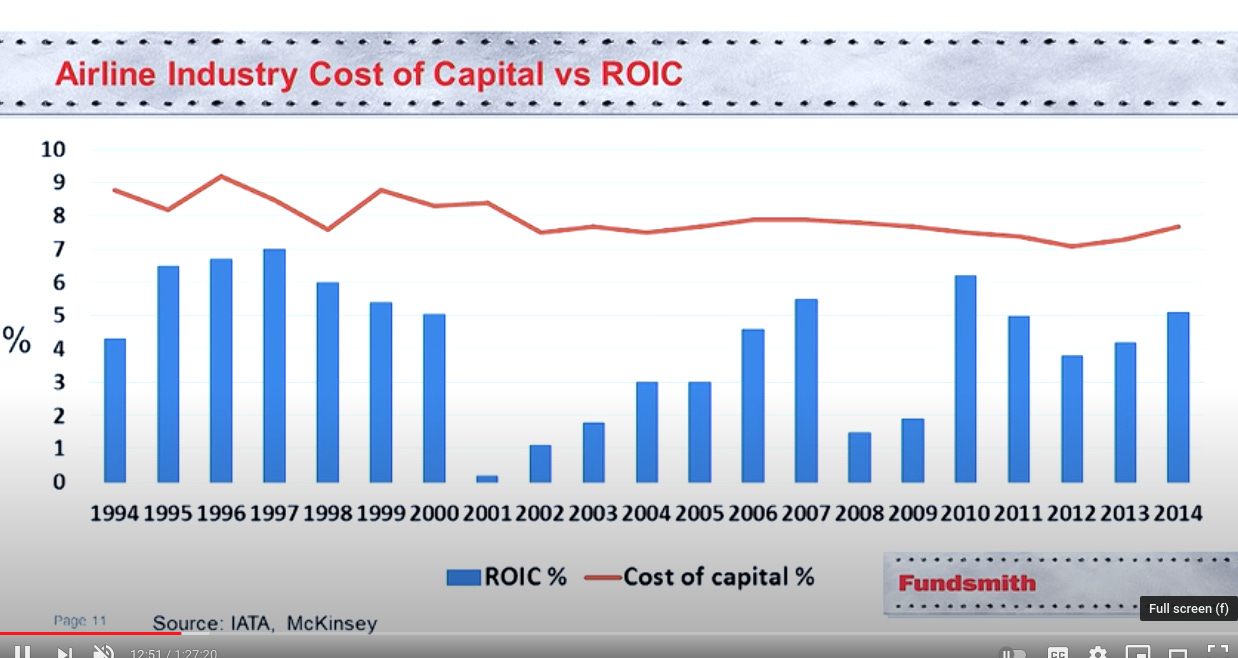

As discussed in previous articles Airlines are a poor business that everyone enjoys beating up on. This is because airlines consistently have lower returns on invested capital than their cost of capital.

On average Airlines make -5% per annum in capital deployed, they are a really bad industry generally speaking.

One might wonder why airlines don’t just go bankrupt? Well they do go bankrupt all the time, recapitalize, and then continue operating without much impact to their customers or employees. Shareholders however lose.

There are a number of cyclical factors that can drive airline company share prices higher which people betting on the industry cite as reasons. These include low relative valuations, consolidation, energy price changes, investing during a recession, etc.

However investing in an industry that perpetually doesn’t make returns on capital deployed is like investing in a melting ice cube while you wait for good things to happen, assuming they ever do.

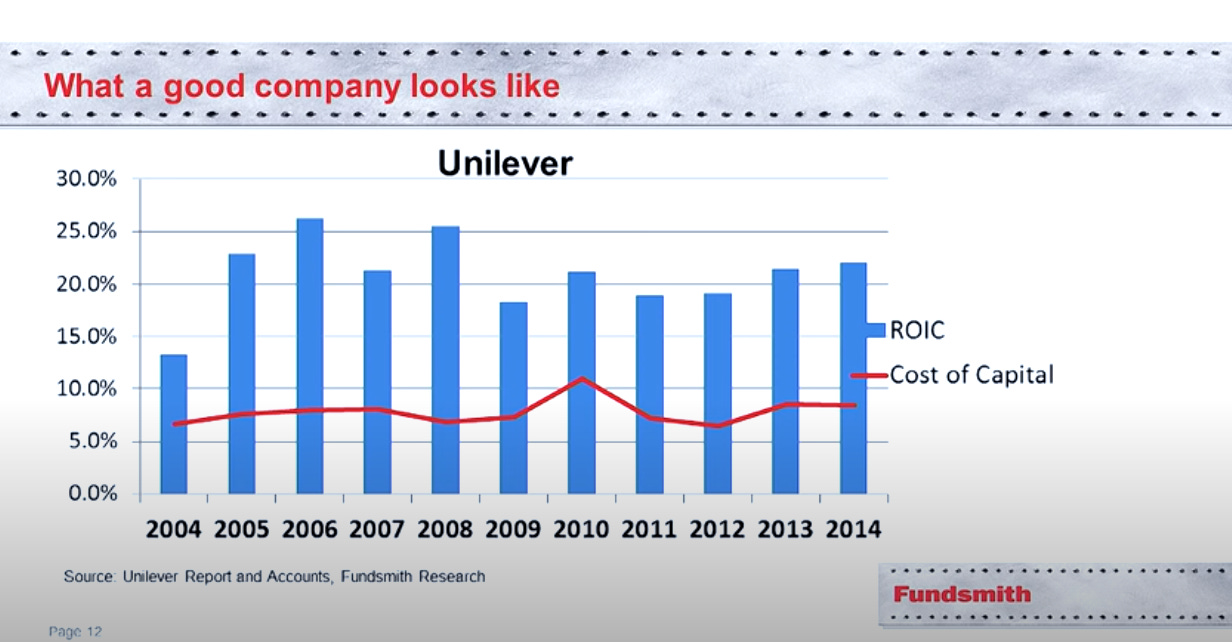

Contrast this with a “good” company.

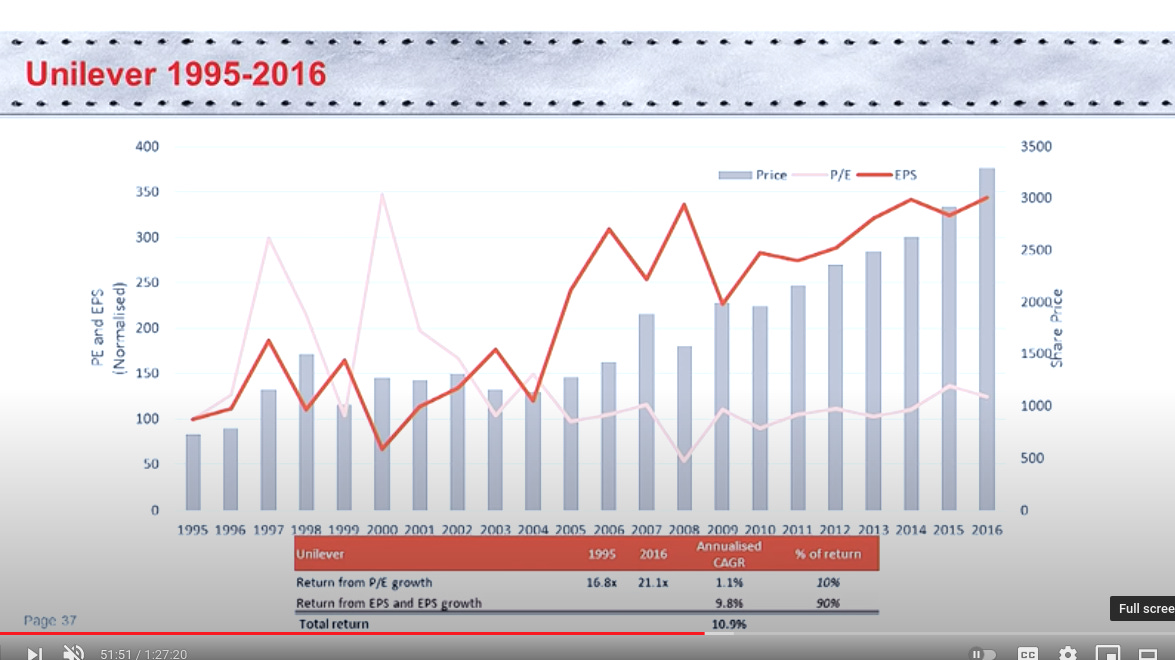

Unilever is a “good company”, it grows in value steadily year by year because its returns on capital are at such an excess compared to its costs of capital. Even if you time it the investment wrong (investing in 2008) the high returns on capital could “dig you out” over time. This contrasts structurally bad industries where timing really is everything.

Growth in earnings can be an illusion in the absence of looking at returns on invested capital and many high growth companies do fail if their revenue growth doesn’t generate durable advantages.

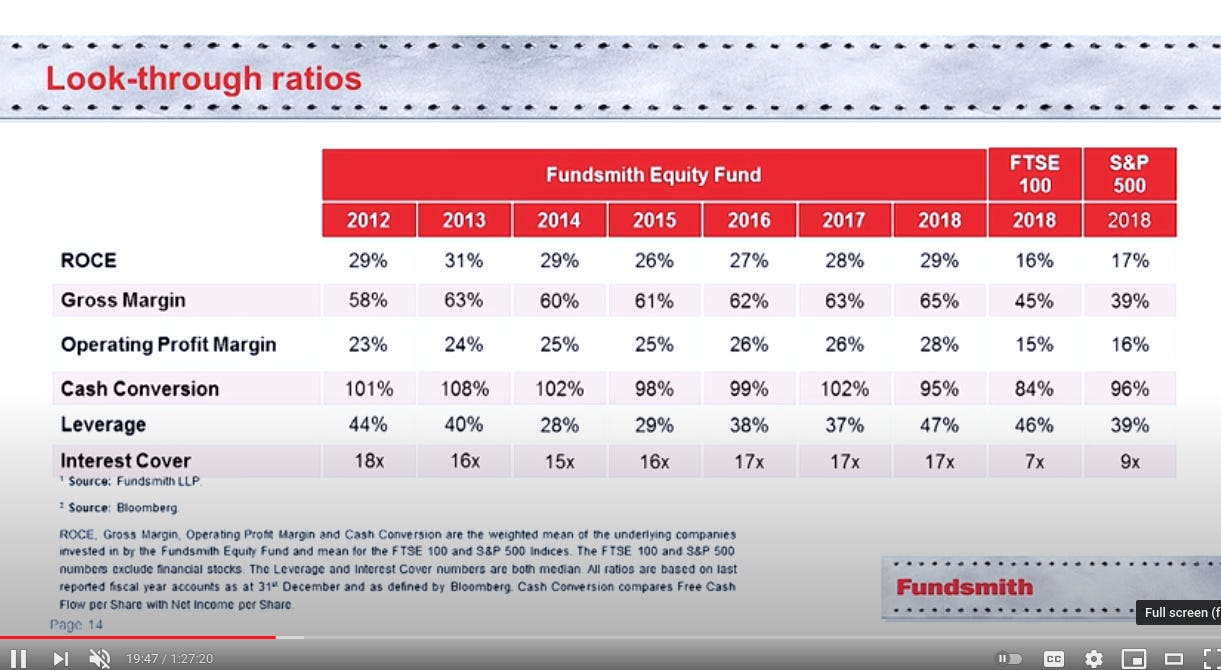

Fundsmith publishes their “look through” metrics and compares that to the return on capital employed of the FTSE100 or S&P500 as a show of quality in their fund.

Growth driven from reinvestment of their cash flows at high rates of return

It’s no good having high returns without a source of growth. Without a source of growth a company will not be able to retain their earnings and reinvest them at high rates of return. They would instead be forced to pay them out in dividends. You should never invest for income, but instead invest in companies that can retain their income and reinvest it in sources of growth. Specifically the desire is for secular growth, not cyclical growth.

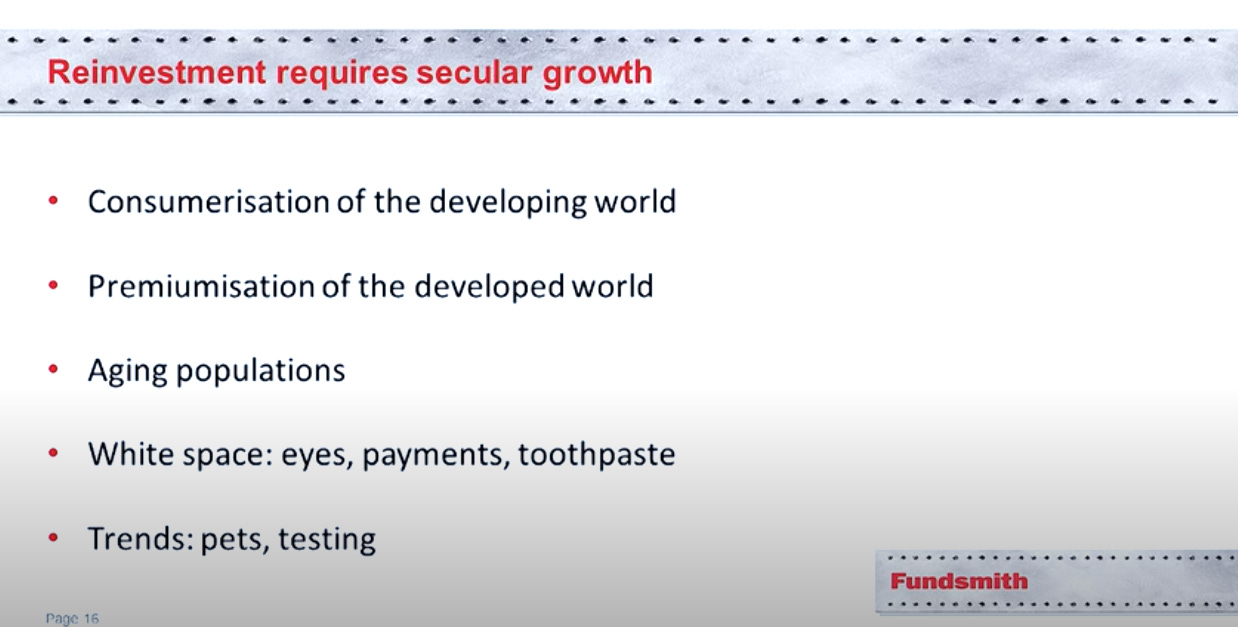

Reinvestment requires secular growth

Fundsmith looks at several areas for continued secular growth. One is the consumerization of the developing world. As the global middle class grows they will consume more products that improve their quality of lives.

Another source of growth is the premiumization of the developing world. For example we might not drink as much as we used to, but we drink more expensive drinks than we used to. Examples would be craft drinks vs mass market drinks.

Another is aging populations. Demographically the world is becoming older on average and companies that best serve the growing population of elderly will do better.

White space, white space is a marketing term for an area you can grow into over time. The majority of people who need vision correction globally have not gotten it yet, but once they can afford to they likely will.

Another theme with tremendous white space that Fundsmith likes is Payments. That is partially because their big competitors are actually not each other but cash which still makes up most of the world’s transactions. Explaining to your children how cash is created, managed, circulated, collected, then distributed again will seem insane compared to going to Starbucks and buying a coffee with their app.

Pets are a fabulous growth area in the developed world and increasingly in the developing world. We are prepared to spend seemingly unlimited amounts of money on our pets. There are a tremendous number of specialty pet foods for every imaginable goal you have for your pet. However, the pinnacle of pet businesses is veterinary care. One type of company they invest in is veterinary diagnostics because pets cannot communicate how they feel.

Testing and diagnostics outside of the veterinary business are also interesting to them. Testing is a growth area because of the growth of the nanny state, and trends to safety. Think of testing meat for contaminants or increased medical screening.

Make money from a large number of everyday, small ticket, repeat, predictable transactions

Major construction projects and movie studios are two examples of businesses that make money in large chunks where a lot can go wrong.

Recurring everyday, predictable events are the things Fundsmith likes to invest in.

Reservation systems, payments, grooming, eating, and drinking are all themes Fundsmith invests in.

Able to protect returns against competition

There is a law of economics called mean reversion. When companies make high returns on capital it attracts competition and competition lowers those returns.

What do you have that can protect against competition?

Usually it is one or more of the above. We will pay more for branded goods than unbranded goods, and we pay more for primary brands than secondary brands. Brands, unlike patents can last forever.

Distribution is another factor, if we brainstorm a new vodka many distributors will already have exclusive agreements with incumbents. Getting it in front of consumers at scale will be challenging if possible at all. Building supply chains from scratch is difficult (e.g. Milk products). If you enter the milk market you must build that supply chain and distribution network from scratch.

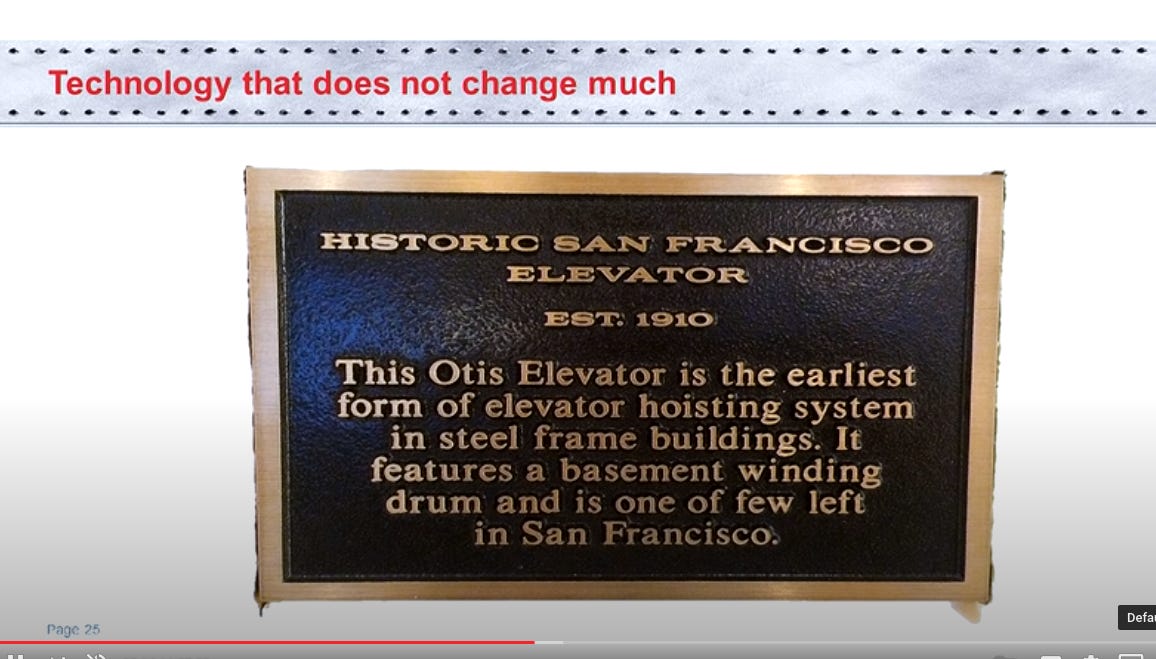

Sometimes it is an install base of equipment or software that protects against competitors. Examples are elevators and escalators. Legally they must be serviced, and that is where most of the business comes from: maintenance not installs. Another is software that once installed is difficult to replace.

Patents are their least liked form of moat because patents expire.

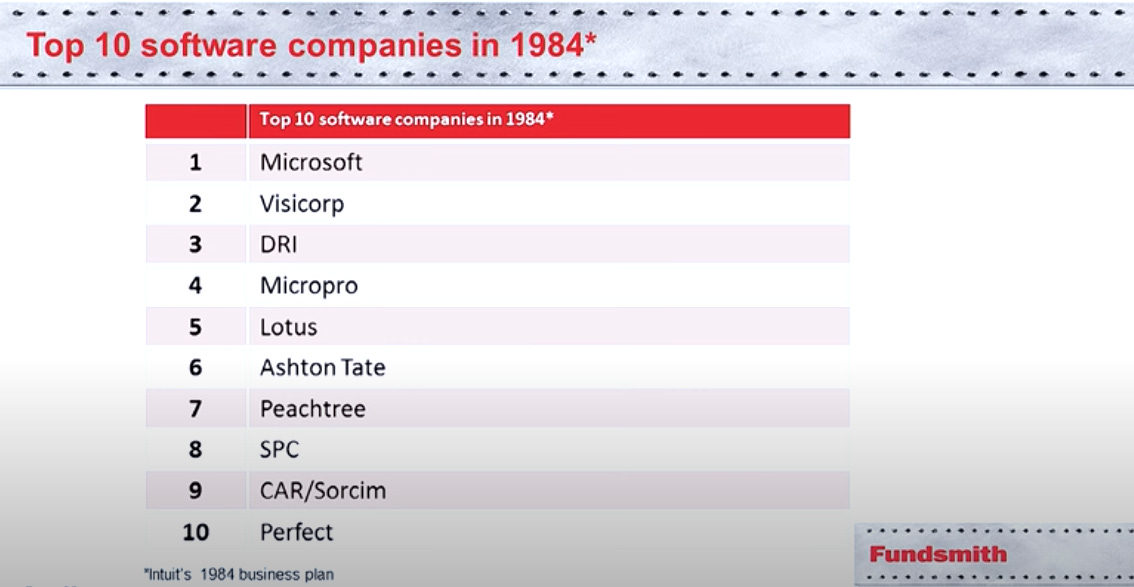

We like companies that are resilient in the face of technological change. It is difficult to predict the winners in companies subject to massive technological change.

Of the top 10 software companies in 1984 only 1 exists anymore, they believe this makes picking long term winners in tech difficult.

Another industry with rapid change and shifting incumbents is biotech and pharma.

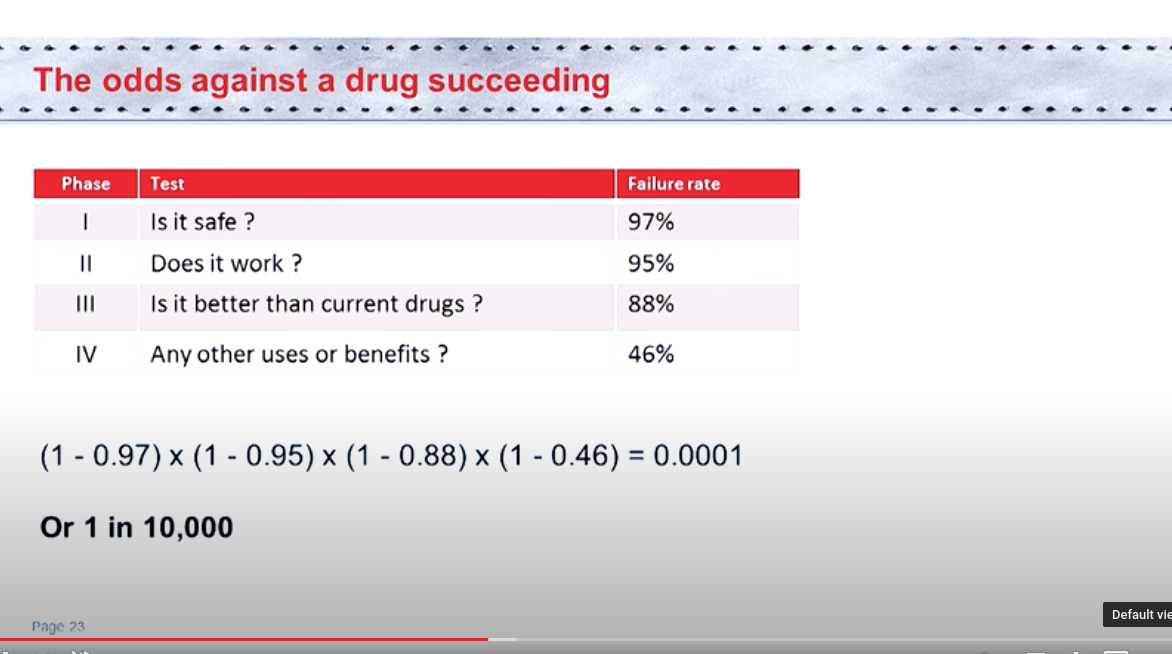

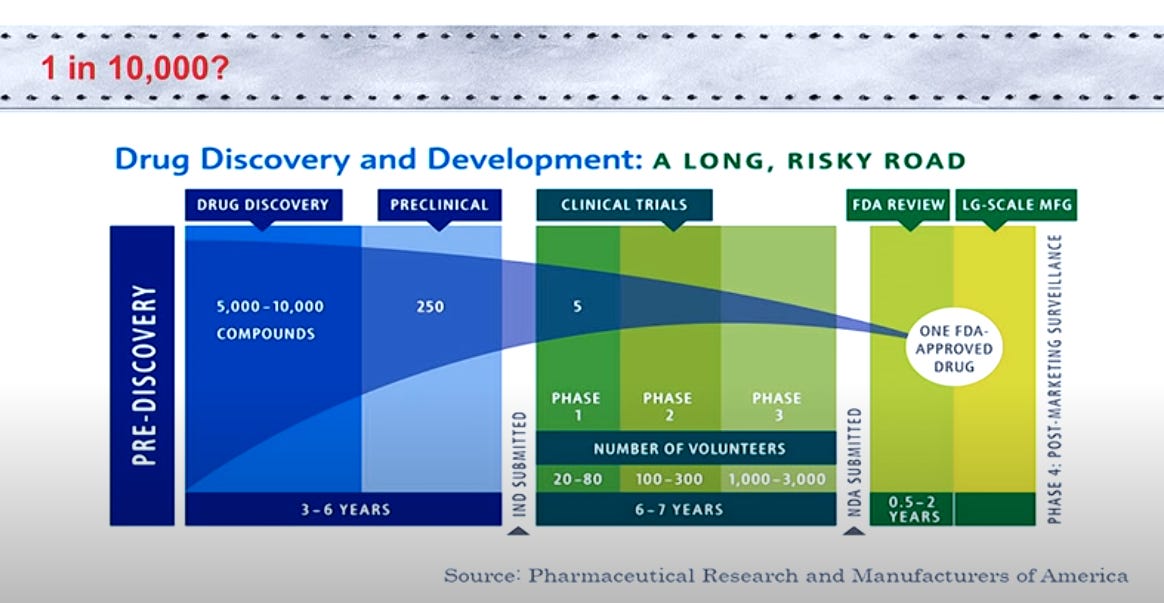

Most countries have a 4 part approval process for drug approval. The odds of the company getting through all the stages of potential failure is actually very low.

Fundsmith believes this is a really bad industry from an investment standpoint as a result of the difficulty of predicting winners and losers in advance.

Otis’s safety elevators have not substantially changed in over 100 years but the problem they solve has persisted and so has their business.

Intangible Advantages

We don’t like tangible advantages (like buildings) because you can always replicate buildings with debt. Intangible businesses to contrast can not easily be replicated.

Companies Fundsmith believes has intangible advantages:

Terry likes to invest in companies that have already won, not try to pick who is going to win. Brown-Forman the distiller of Jack Daniels survived not only 2 world wars and the great depression but also prohibition of alcohol. Fundsmith also likes companies that can leverage other people’s money such as franchises.

Don’t Overpay

Is it cheap is an important question, but a secondary one to if a company is truly a good business.

Overtime valuation will be less important than the fundamental returns of the business if those returns are sufficiently high.

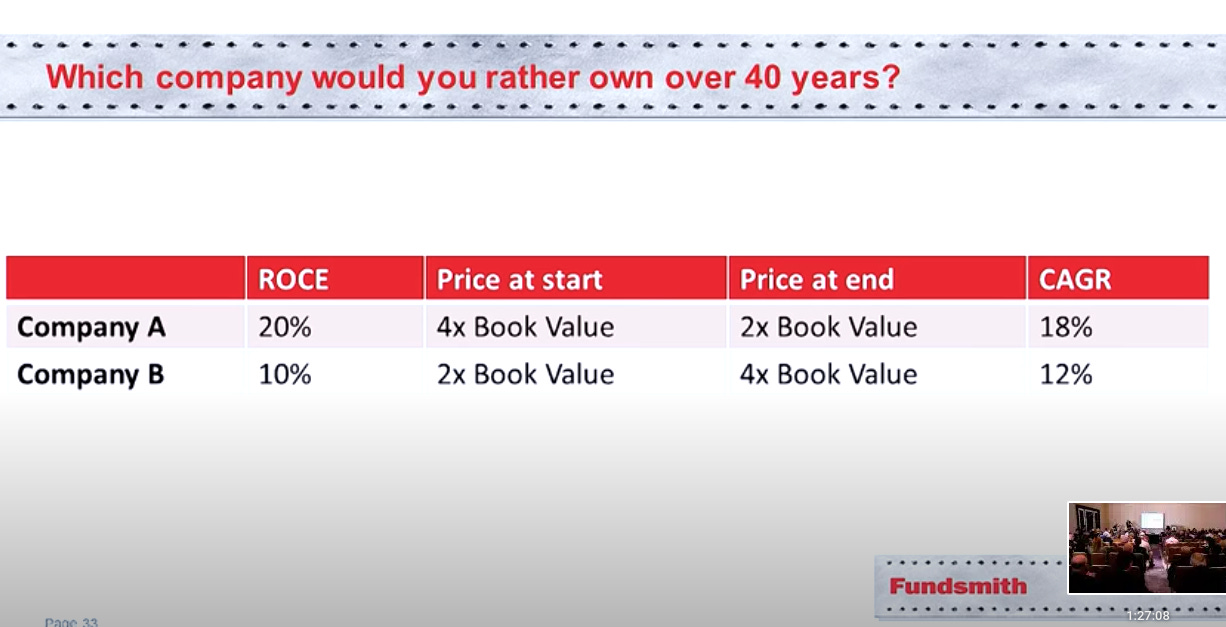

This example is helpful for understanding the compounding of two businesses with differing growths, initial valuations, and ending valuations:

Over the long term the higher returns on capital of company A overwhelmed both the valuation compression of company A and the multiple expansion from a lower starting valuation of company B.

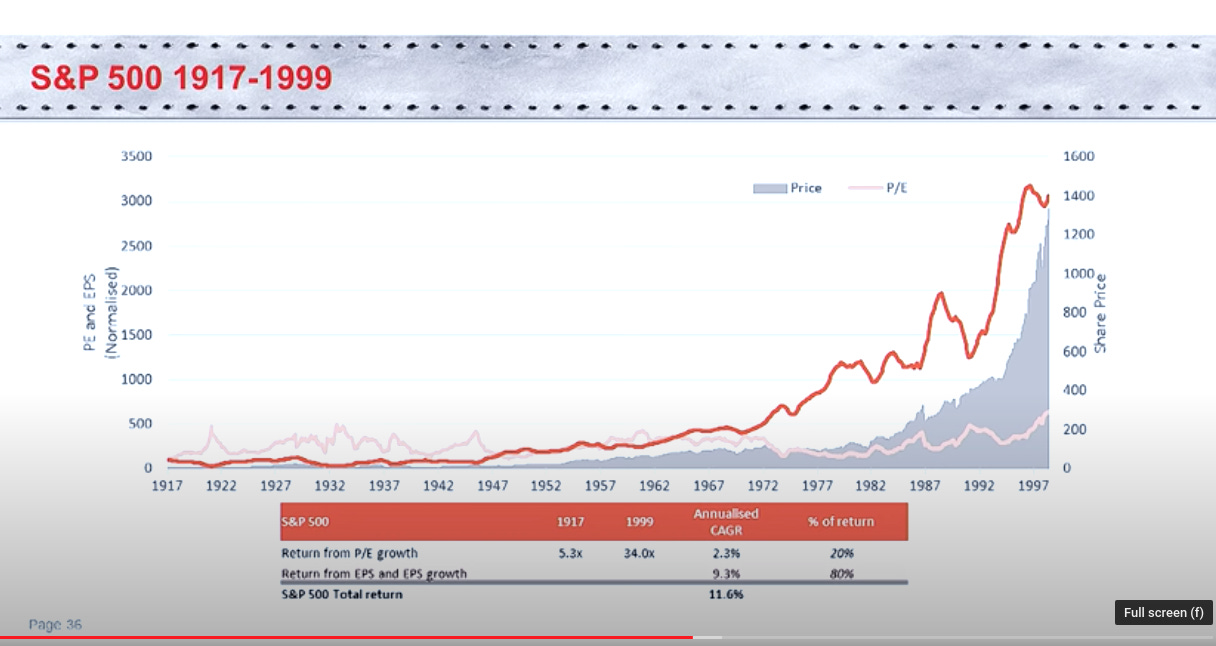

The vast majority of index returns (80%) come from EPS growth not multiple growth.

Looking at a “good company” like Unilever this is shown to be even more true:

90% of the returns over the period can be attributed to EPS growth, and only 10% from P/E growth. Most of the returns come from what the company does not what you as an investor do when investing in good businesses.

Fundsmith does however compare valuations (FCF yields) within their portfolio among each other, their investable universe, the broader market, and bonds. They also project their FCF out 4 to 5 years into the future to compare their companies growth rates and to balance current and future projected FCF yields when making decisions.

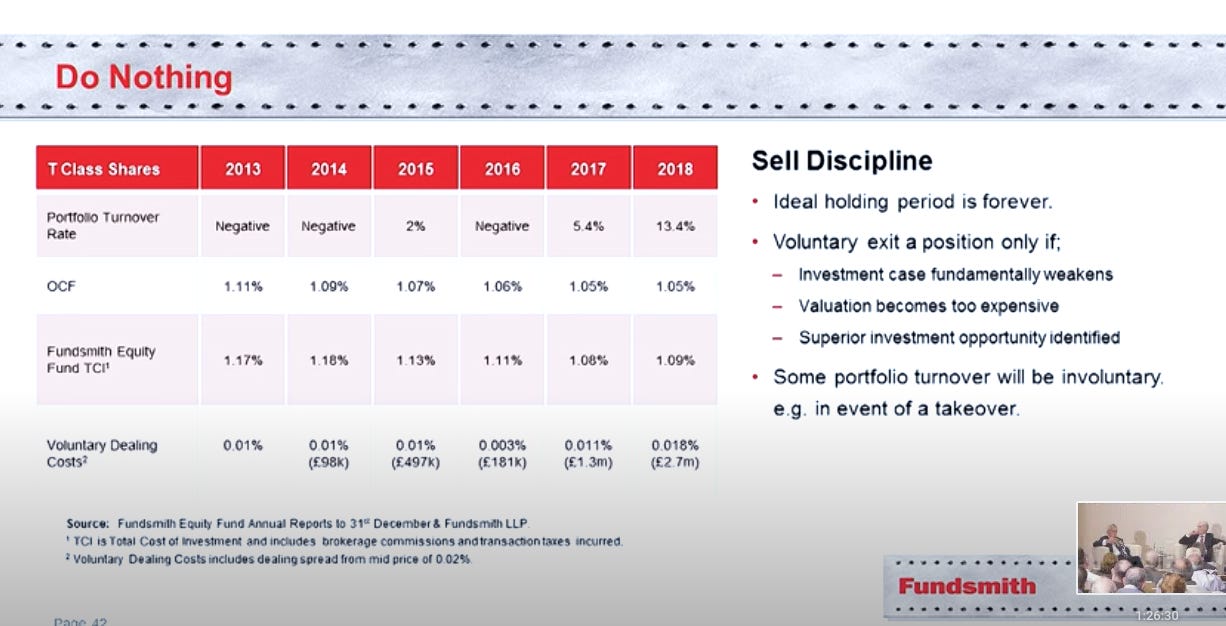

Do Nothing

“Almost every time I sell a good company it is a mistake.”

Miscellaneous, Q&A

Fundsmith has extremely low transaction and voluntary dealing costs relative to the industry because they almost never make transactions.

Fundsmith looks for big private companies that are similar to the public companies they invest in. Examples include Mars (Candy, Pet Foods), Liquor businesses, Franchise businesses (other people’s money to grow), household cleaning products, repeat use medical products, and medical devices.

Fundsmith owns 20-30 stocks and invests alongside their investors. They believe this gives them a sufficient degree of diversification and aligns incentives.

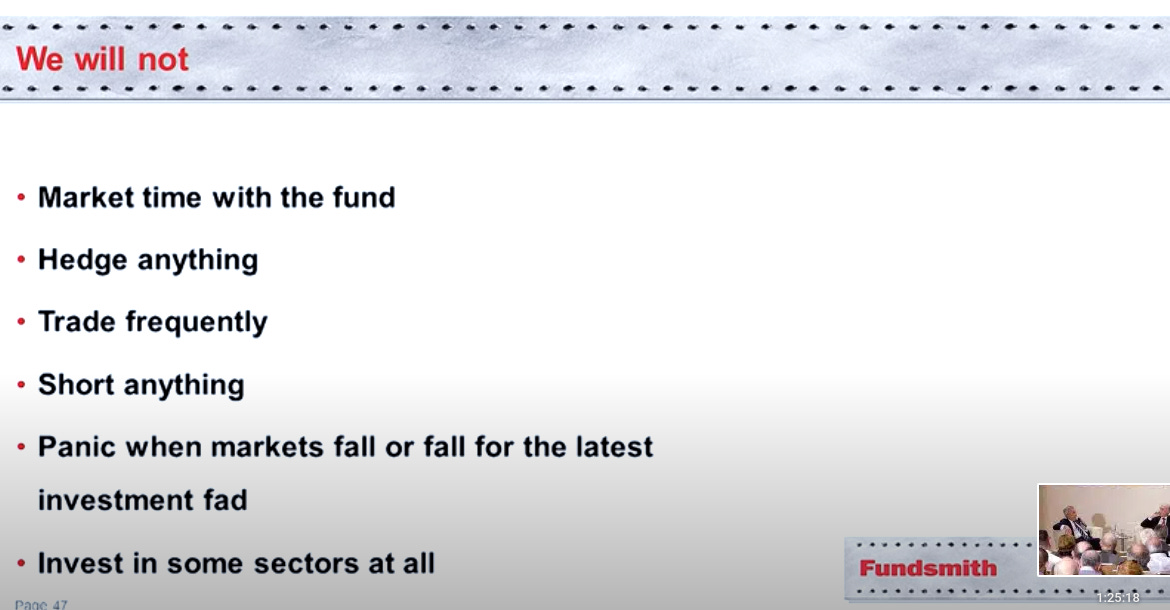

Fundsmith won’t own resource companies, utilities, airlines, banks, insurance, or other cyclical companies.

They don’t attempt to make macroeconomic predictions. They believe the best hedges against inflation are companies with pricing power as shown by high gross margins.

If you liked this and would like to see more similar content please subscribe, share, and like.